|

Client/Account Edit View |

|

|

|

|

Client/Account Edit View |

|

|

Client/Account Edit View

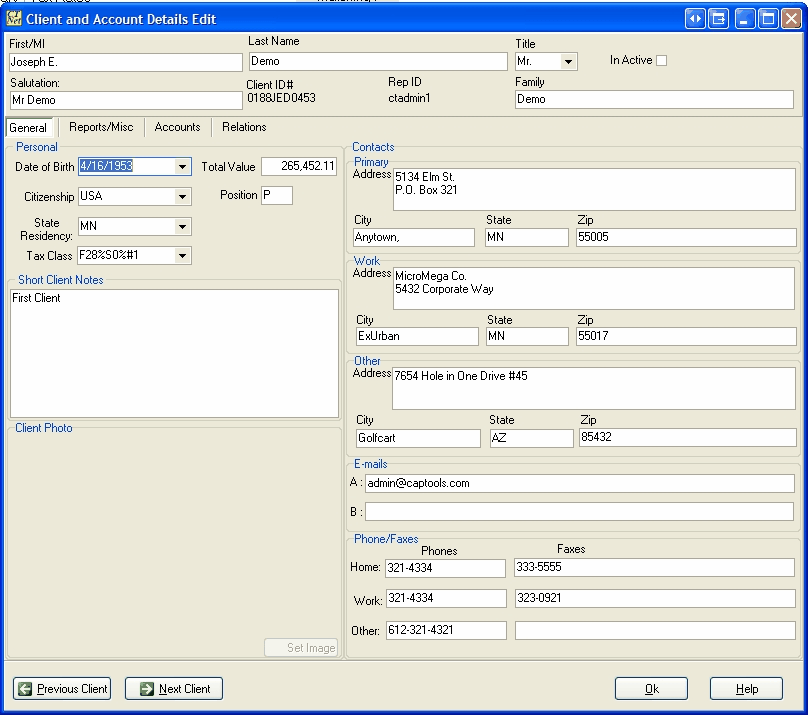

The Client and Account records for a single client can often most easily be viewed and edited as a single entity through the "Client/Account Edit View". This view is accessed by double clicking on any client or account record (except the "short name" field), or by selecting any client or account record and executing the "Data/Edit Record" command. This produces a special record display and edit form appearing as follows (Note: this dialog may appear wider or narrower than this example depending upon your screen resolution. Click on the edge of the dialog and adjust the size as appropriate; this size will be retained in future sessions):

This view of the Client and Account records contains about every bit of contact management information that you might need to support your clients.

General View

This the "General" tab view, displayed above, is self-evident in operation, for the most part. Three addresses, three phones and two emails are supported, and can be edited on this screen.

Total Value - This is a view-only field, which contains the most recent combined total value of all accounts containing the client's Tax ID.

Tax Class - This field specifies which tax rate records are to be used for estimated tax computation for this account. Tax rates are covered further in the topic Tax Rates, later in this chapter.

Short Client Notes - This field is intended to contain a brief amount (less than about 500 characters) of profile information about the client.

Client Photo - This field, allows you to link a photo of your client into the form. The "Set Image" button allows you to upload an image from your PC to the client's folder on the Captools/net server computer. This folder may also be used to store any scanned document relating to your client.

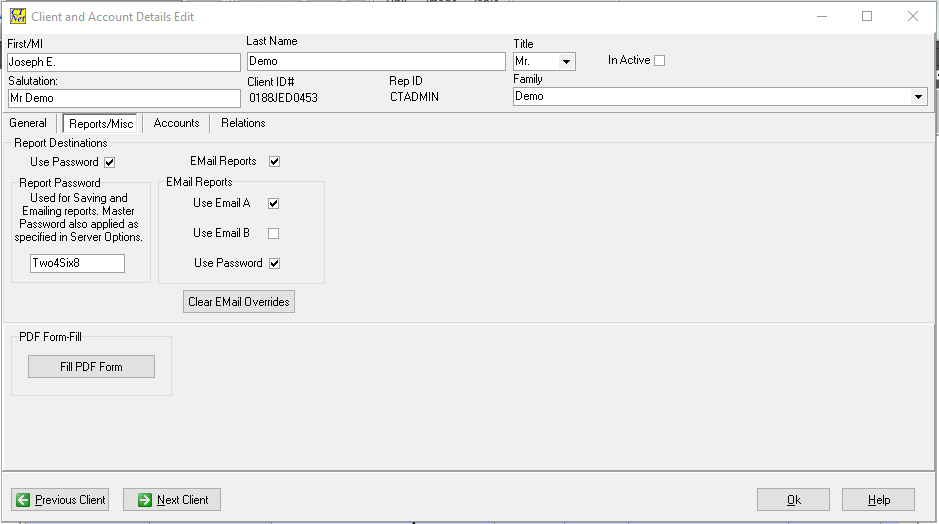

This edit view of the client record provides client record level controls for reports as follows:

These controls are used to specify, at the client level, the format in which reports are to be generated and where the reports are to be directed. The report addressing specifies which of several client addresses are to be used. If more than one address or e-mail is specified, multiple reports are generated, so this should only be done if you intend to send reports to more than one address as this will slow the report generation process.

Report e-mailing is available only in higher level Pro and Enterprise program versions. E-mailing is performed by the CTTasker program and discussed further under the topic E-Mail Reporting. E-mailed PDF reports can be password protected by specifying a password for the account. (Note: Fax support has been deprecated due lack of fax ports on all but old computers).

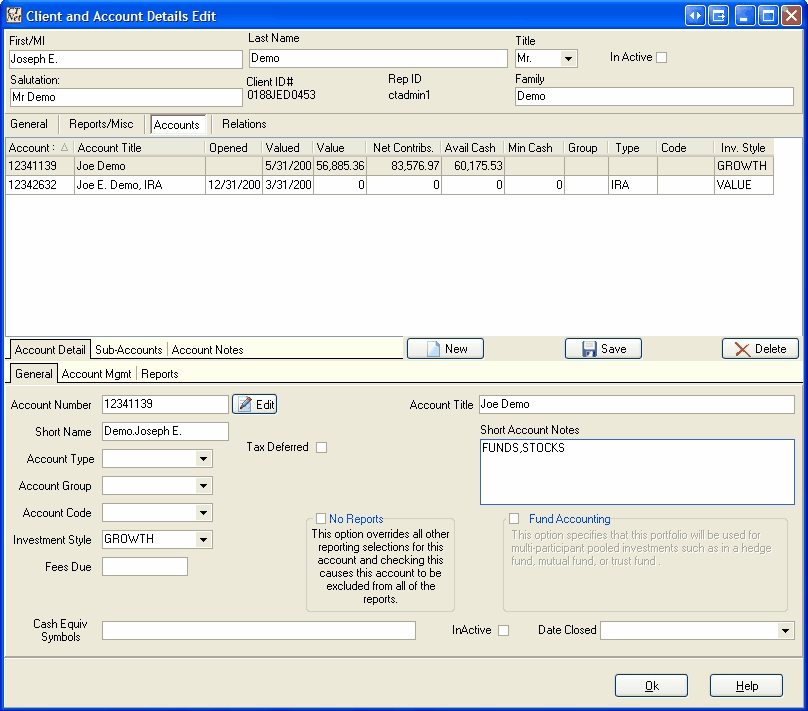

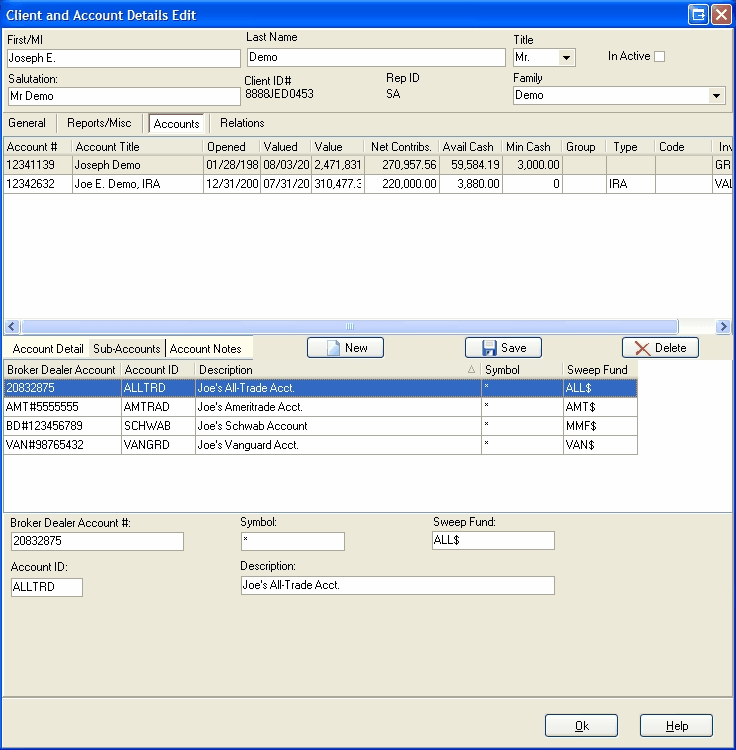

The Client/Accounts "Accounts" view, shown as follows, is the most involved of the sub-views in the Client/Account Edit form:

The account information near the middle upper part of this view shows the accounts which belong to the client identified at the top of the form. Selecting one of these accounts causes the detail for that account to be displayed in the lower half of the form. That detail is in turn displayed via a multi-tabbed sub-form operating as follows:

Account Detail/General

This sub-form allows you to view and edit the account identity information as well as specify some of the more frequently modified account controls. Most of these fields are self-evident in operation, however the following are of additional note:

Account Number - Changing this field will result in the account number being changed for all underlying dependent records such as portfolio records. For this reason, you need to click on the adjacent "Edit" button in order to gain access to edit this field. Upon clicking this button you will be warned that other records will also be changed.

Cash Equiv Symbols - This field allows you to identify for each account what symbols are to be treated as cash equivalent securities. This information will be used in reporting.

Short Account Notes - This field allows you to store brief key information about this particular account. Longer notes involving this account or client should be stored in the Account Notes records (see account notes).

Fund Accounting - This group of controls is available only on versions (Pro 3/higher) on which the Fund Accounting option has been licensed. Checking this group activates fund accounting for the account, as well as allowing you to set the controls in the box. See the Appendix on Fund Accounting for more details.

Tax Deferred - Check this field if the account is a retirement account upon which no taxes are levied until funds are withdrawn. This will cause the portfolio Estimated Tax field computations to be suppressed except for account withdrawals. See Individual Retirement Arrangements (IRAs) for more details.

No Reports - Check this to suppress report generation for this account only whenever reports are run for a group of accounts either manually or through the task scheduler (Pro 3/higher versions). This will exclude this account from all reporting including cross-reference reports and performance composites.

Inactive - Check this if you want the account portfolio to be excluded from all processing including new valuations and reports encompassing periods after the Date indicated in the adjacent Date Closed field. If an account is marked Inactive but No Reports is not checked, then the account will be included in cross-reference and composite reports if the reporting period includes time prior to the indicated close date.

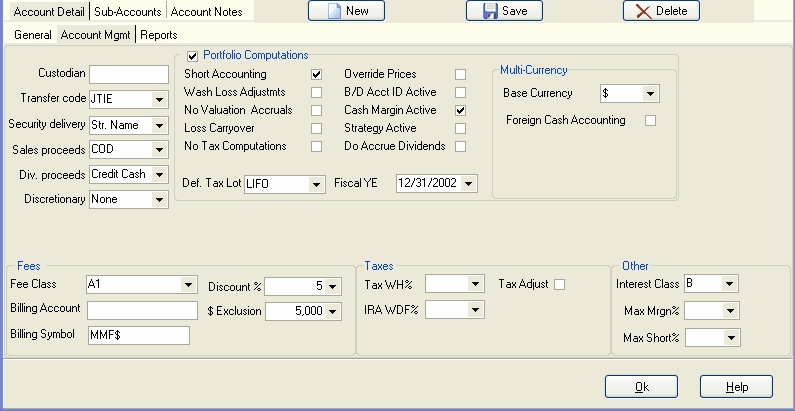

This sub-form allows you to view and edit fields which store information on how the account is managed, and in some instances also control how Captools/net performs its computations.

Custodian..Discretionary - These fields define how the account is to be managed, generally as agreed between the client and you or your firm. These fields should be self-evident in meaning.

Portfolio Computations - These fields control how various portfolio computations are performed. The check box next to the group label must be checked to give you access to edit these settings. It also acts to "lock" the settings to prevent them from being overridden by changes made in the Program Preferences ("View/Set Program Prefs" command). If you want the settings in the Program Preferences, Account Options to prevail, then leave the group check box unchecked and these fields will be modified any time you change the options at the Program Preferences level. See Portfolio Computations in the Portfolios chapter for more detail on how these settings operate.

Multi-Currency - These fields are only applicable to accounts which contain securities denominated in more than one currency. See Multi-Currency Portfolios for more details on these settings and on running multi-currency portfolios.

Fees - These fields control how Pro and higher versions of the software compute management fees billed on client accounts. See Management Fees/Billing for more detail on how these operate.

Taxes - These fields specify miscellaneous tax-computation related options. The Tax WH% field specifies the percentage of withholding to be automatically applied to various portfolio transactions to satisfy tax authority (IRS) requirements for the particular account. The IRA WDF% specifies the minimum annual withdrawal percent required in tax deferred accounts if the account holder is past a certain age (See Individual Retirement Arrangements (IRAs) for further details). The operation of the CG Index and Tax Adjust fields are covered further in Tax Computations.

Other - These fields apply to certain higher program versions (Pro 4/higher). "Interest Class" field applies to the generation of Credit or Debit interest on account cash balances as covered in Credit/Debit Interest. The Max Mrgn% and Max Short% allow you to generate account-specific warnings for accounts managed using margin and short strategies. These will be indicated by coloration of the Rem. Margin field in the Account record grid view.

Def. Tax Lot - This field (in the "Portfolio Computations" group above) is used to specify the tax lot method to be used in a portfolio closing transaction if no method is specified in the Security Id record for the transaction symbol.

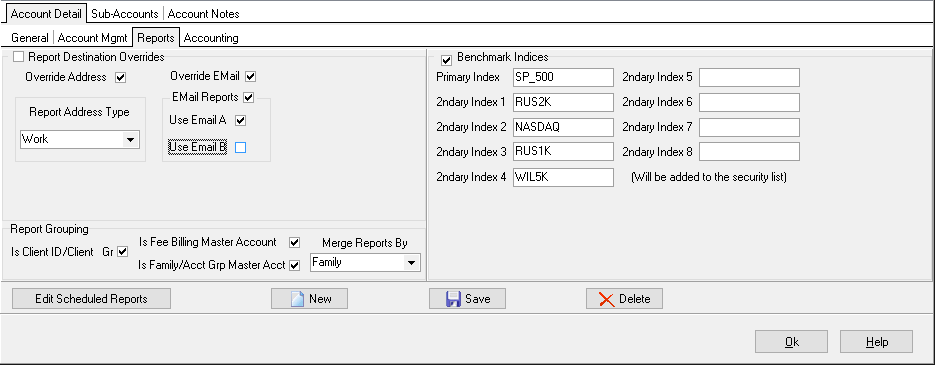

This Client/Accounts Edit sub-form allows you to set report related specifications at the account level.

Account Address Overrides - These fields allow you to specify report destination addressing for each account which differs from the addressing specified for the account's client record (see Reports/Misc View). The "Address" field specifies which of the client's addresses will be printed on a report if the report specifies an address. Likewise for the Phone, Fax, and Email fields. If the report is to be e-mailed the email field specifies which of the two possible client email address is to be used. If the reporting merges data from multiple accounts, the addressing used is that for the account specified as the "master" account for the merged report in the "Report Grouping" group (see next item).

Benchmark Indices - These allow you to specify the symbol for up to nine indices to be used in your account performance reports. If the group check box is unchecked then the Benchmark Indices specified at the Program Preferences level will be updated to this record whenever they are changed.

Report Grouping - These fields specify whether reports for an account are to be merged with other related accounts and/or whether related reports are to be consolidated. "Merged" reports combine data from multiple accounts into a single report according to the merge criterion, typically by Tax Id or by Family designation, although client or account group can be used. The Fee Billing, Client ID and Family "Master Account" settings specify that the account will be the basis for determining which address, email, etc. are to be used for a merged report. If more than one account used in a merged report is specified as a master, then the first such account processed during report generation will be used. The processing sequence will generally be determined by account open date.

Scheduled Reports - These allow you to specify report generation to be scheduled by the server-side CTTasker program. These typically will be reports generated in PDF format to be either e-mailed to the client or placed in the client's folder on the web server so he/she can view it when they next log-on. If the group check box is unchecked then the Scheduled Reports specified at the Program Preferences level will be updated to this record whenever they are changed.

The "Sub-Account" sub-form on the Client/Accounts edit view permits you to view and edit sub-accounts assigned to the account selected in the top section of the form:

The "New" button permits you to create a new sub-account record on this view, while the "Delete" button permits you to Delete one. Use the "Save" button to post an edited record to the database. Sub-accounts are discussed further in the Sub-Accounts topic

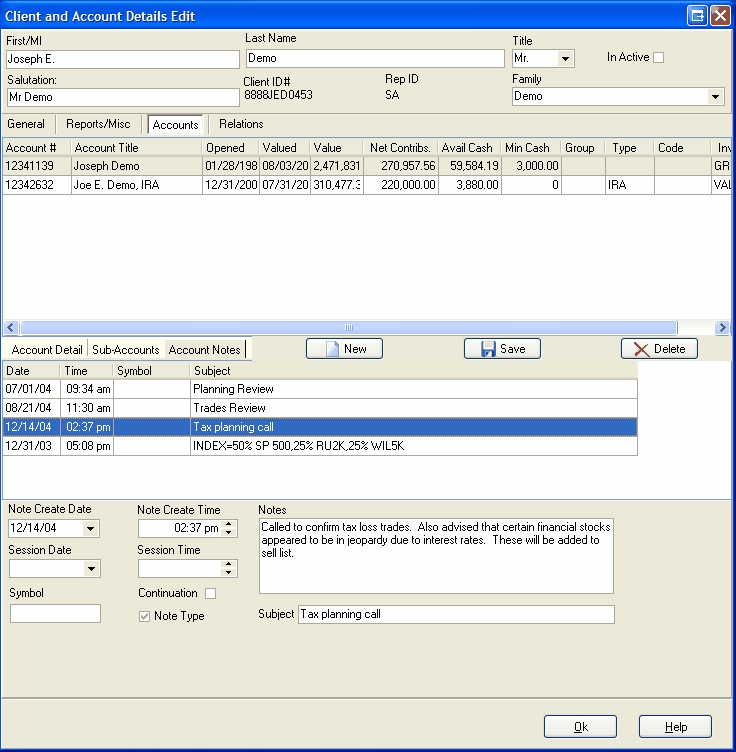

The Account Notes sub-form permits you to view and edit the Account note records assigned to the account selected in the top section of the form. The Note records allow you to keep a record of notes on meetings and calls with clients:

In higher levels of the Pro and Enterprise versions, the account note records can also be used to define "blended indices" to be used in performance reports for an account. Performance reporting and blended indices are covered in more detail in the topic Performance Reports.

The "New" button permits you to create a new sub-account record on this view, while the "Delete" button permits you to Delete one. Use the "Save" button to post an edited record to the database. Account Notes are discussed further in the Account Notes topic

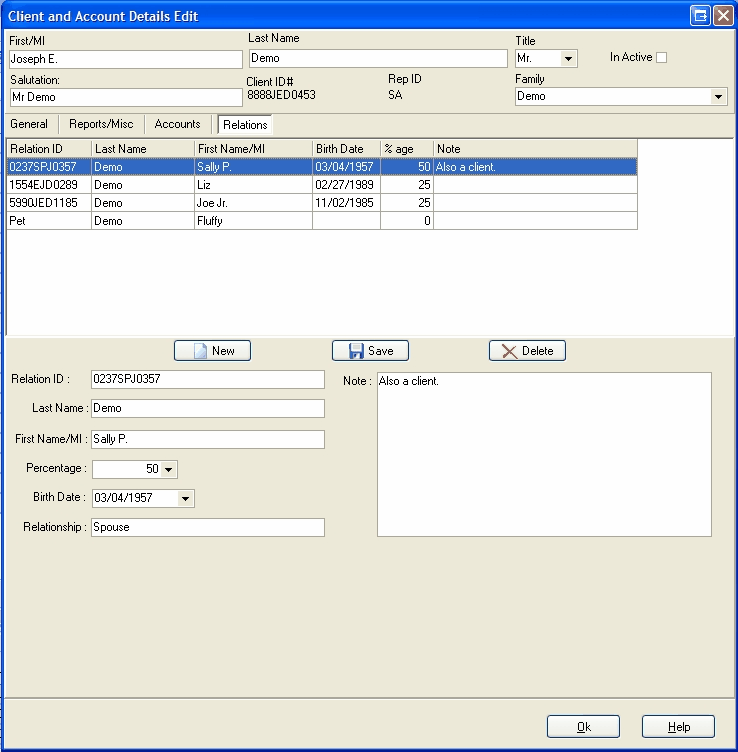

The last tab on the Client/Account record Edit dialog permits you to view and edit records involving the client's relations: