|

Individual Retirement Arrangements (IRAs) |

|

|

|

|

Individual Retirement Arrangements (IRAs) |

|

|

Individual Retirement Arrangements (IRAs)

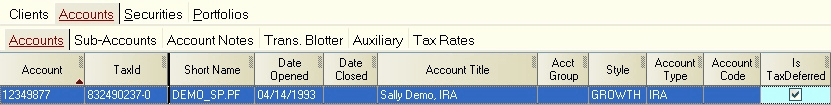

Because of their special tax treatment, tax-protected retirement accounts such as IRAs (Individual Retirement Arrangements) for U.S. taxpayers, should generally be kept in a portfolio file separate from investments subject to normal taxes. These accounts should be checked in the "Is Tax Deferred" account record field:

This ensures that estimated taxes are computed as zero for all transactions, except withdrawal type transactions (e.g. WDF, SLW, INW, DVW, SGW, CGW, etc), which are taxed at the Federal and Local rates listed for the tax rate class specified for the client in whose Client Id account is held.

Transactions within an IRA portfolio are handled in the same fashion as for a normal taxable portfolio, i.e., you may purchase, sell, and receive dividends and interest on stocks, bonds, mutual funds and other investments. The only exception to this is in the handling of contributions to, and withdrawals from, the portfolio.

Account Contributions - Contributions to retirement accounts can be classified as either deductible or non-deductible for determining taxability upon the ultimate withdrawal of funds from the account. For U.S. taxpayers, Deductible contributions are earnings on which you have not yet paid taxes because the IRS has allowed them to be deducted from reportable gross earnings if you are not ineligible due to participating in an employer sponsored retirement plan. Non-Deductible contributions are those on which you must pay taxes but which you contribute to the retirement account so that earnings thereon may accumulate tax-free, such as in a Roth type IRA.

Deductible and non-deductible contributions must be kept separate so that when account withdrawals begin, you will be able to properly claim non-taxability for withdrawals coming from the principal part of non-deductible contributions. If deductible and non-deductible funds are co-mingled you will not be able to separately identify these components. The best way to do this is to maintain separate brokerage accounts for these types of funds and track them as separate accounts in Captools/net.

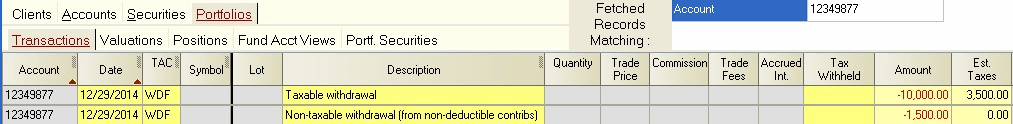

Account Withdrawals - Taxes on retirement funds are normally levied at the times the funds are withdrawn from the accounts. Captools/net will compute estimated taxes on such withdrawals at the accounts specified tax class Federal and Local rates. One exception is if withdrawn funds represent the principal part of non-deductible contributions. In this case there is no tax due. This can be indicated in the transaction by manually entering "0" in the estimated tax field of the withdrawal transaction.

Penalties due to early withdrawals from the retirement account must be explicitly entered in the transaction Estimated Tax field. Amounts which are withheld from withdrawals and paid to the tax authorities should be entered in the transaction Tax Withheld field.

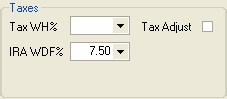

Computed Minimum Withdrawals - U.S. federal tax law mandates that minimum withdrawals must be made each year from tax deferred accounts when the owner reaches a certain age, (currently after age 70 1/2) at a rate which is determined by federal actuarial tables. You may specify this rate in each tax-deferred account in the IRA WDF% field in the Taxes group on the Account Mgmt tab in the account record Edit view:

If you enter a fiscal-year-end WDF or SLW transaction in a tax deferred portfolio and click the calculator icon (or use the Data/Compute command), the minimum required withdrawal amount for that account will be computed and filled in the Amount field, taking into account any prior withdrawals that have occurred in that account during the year. Note that this feature cannot be used if the account holder has several tax-deferred accounts and will be withdrawing non-proportionate amounts from each.