|

Transactions |

|

|

|

|

Transactions |

|

|

Transactions

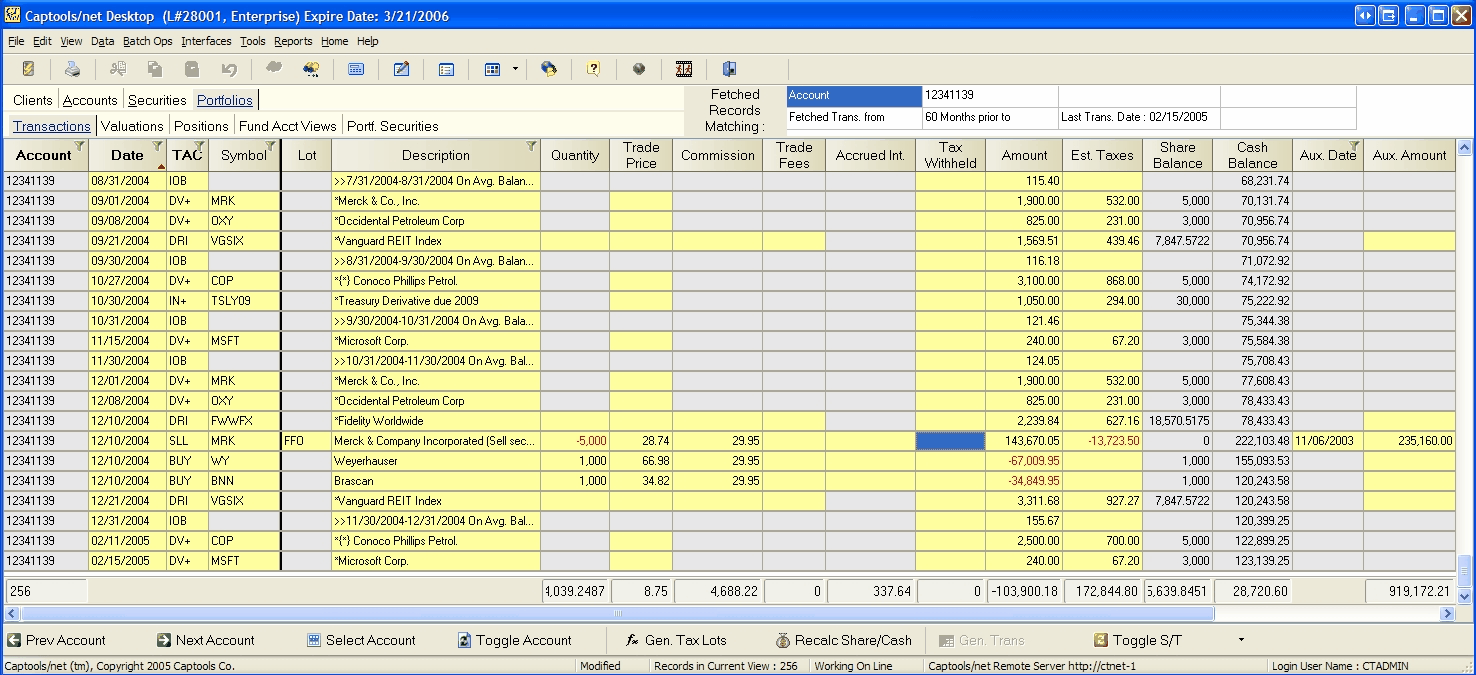

Portfolio Transaction records maintain a history of all investment activity in an account. The typical standard grid view of these records appears as follows:

New Records - Much of the information in Transaction records is provided at the Pro/Enterprise program level through imports of custodian provided data, imported into the Transaction Blotter table and then transferred to the portfolios using the "BatchOps/Transfer Blotter" command. At all program levels, transaction record data can be manually entered, and in some cases imported through an import or download discussed in the topic Generic Imports. To manually enter a new record, you simply need to hit the "insert" key, or hit the "Down Arrow" key when the screen is focussed on the last record in the view.

Important!: If you have a large volume of data to manually enter, it is strongly recommended that it be entered into the Transaction Blotter and then transferred to the portfolios. This is because the entry of data into the transaction blotter does not trigger any computational events unlike portfolio transaction data entry, and thus will provide more time efficient data entry.

New Symbols - If a new record also involves a new security symbol which is not found in Captools/net database, a web-based "lookup" will be triggered (unless suppressed in the Program Prefs) to find the security description and other security information for the new security record. This may result in a delay before the focus returns to the next data field or record.

Transaction Record Fields

The transaction record fields operate as follows:

Account - This is the identifier of the account to which the transaction belongs. This field is intentionally "view only" to prevent inadvertent change of the account number. New records are assigned the account identifier of the currently focused account record.

Date - This is the date on which the transaction occurred. For "buy" and "sell" transactions, this should be the trade date, not the settlement date. This field is always required.

TAC - This is the "Transaction Code". This indicates what kind of activity is represented by the transaction record. There are approximately 70 transaction codes available. These are described in more detail, with examples in the topic Transaction Codes. When a transaction code is entered, CT/net gray's out fields which are not applicable to that type of transaction. For imported data, the TAC code is translated from the code used by the data provider into CT/net's code. This translation is specified in the import template.

Symbol - This is the identifier of the security asset involved in the transaction. For market traded securities this should be the trading ticker symbol, or if none is available, the security cusip number. For non-market trades securities you can make up a symbol, as long as it does not conflict with a symbol for a real traded security. If you enter a value in the symbol field which is not found on the security list, then that symbol will be added to the list. Only "Cash" deposit, withdrawal, and interest on balance transactions do not require a symbol. All other transactions must have a symbol identifier to be valid.

Lot - This contains the identifier that indicates how buy and sell transactions are to be matched for determining taxable realized gains. It is usually best to leave this field blank until the closing side of a transaction occurs. Application of this field is discussed in more detail in the topic Tax Lots and Cost Bases.

Description - This contains the description of the transaction. It is ordinarily pre-filled with the description of the transaction's symbol, as found in the Security ID records. You may edit this to provide more descriptive detail, such as "Check #4321". This is not a required field.

Quantity - This contains the quantity of shares or number of units involved in the security transaction. If you first enter amount and price, CT/net will compute the quantity field, however, due to possible difference in rounding conventions you should verify that such a computed quantity matches your mutual fund's statement.

Trade Price - This is the execution price of a trade or the reinvestment price in the case of a reinvestment transaction.

Commission - This is the brokerage commission charged. This will display as a positive number for both buy and sell transactions. You can indicate a reverse of these charges by using a negative number.

Trade Fees - This field is for the combined value of any other trade fees, such as SEC fees. This will display as a positive number for both buy and sell transactions. You can indicate a reverse of these charges by using a negative number. If an "SEC_FEE" record is included in the Security Notes History table, the trade fees will be computed when the record is posted or when you select this field and execute the "Data/Compute" command or click on the "Compute" icon. See SEC Fees for more details on specifying an SEC_FEE record.

Accrued Interest - This field is for accrued interest paid (negative) or received (positive) in either a bond purchase or a sale transaction or bond short sale and cover. This field can also be used to record interest points paid in borrow (BRW) transactions and the interest paid component of repay (RPY) transactions when they are used to record mortgage payments.

Tax Withheld - This field can be used to specify taxes withheld on a transaction, e.g., on a foreign stock dividend. The Amount field is assumed to be net of the tax withheld.

Amount - This is the net amount of the transaction after application of commission, fees, accrued interest and taxes withheld. For trades, this field will be automatically computed based upon quantity, price, commission and fees based upon the computation method you have specified on the View/Manage Views dialog (see below). It may sometimes be necessary to override such a computed quantity by manually keying a value if a mutual fund company's share rounding convention differs from Captools'. See later in this section regarding using the No Amt Calc flag to protect a field value from being overridden by a computed value.

Est. Taxes - This field contains estimated taxes due as a result of the transaction. This field is normally automatically computed when the transaction is "posted" (moving to next or prior record, or "saving/refreshing data"), using the tax rates for the tax class specified in the account's account record (see Client/Account Edit View Tax Rates and/or Tax Lots and Cost Bases for more details). The tax computation may also be triggered by selecting this field in one or more records and clicking on the "Compute" icon or by executing the "Data/Compute" command. You may also manually specify the value for this field.

Share Balance - This is a computed field providing the current share balance for the security symbol contained in the symbol field. This field is updated when the record is "posted".

Cash Balance - This is a computed field providing the current portfolio cash balance. Note that this is the amount in the Captools "Cash" balance. This is computed by netting all cash transactions prior to and including the balance date. It does not include amounts in money market funds. This field is updated when the record is "posted".

Aux. Date - This is a date field which is used for certain types of transactions to specify a secondary date. For example, for Receive (RCV) transactions it is used to specify an original purchase date. This field is also used to indicate expiration dates for futures and options.

Aux. Amount - This is an amount field which is used for certain types of transactions to specify a secondary amount. For example, for Receive (RCV) transactions it is used to specify an original purchase amount. This field is also used to indicate strike prices for futures and options.

Hold Period - This field indicates the capital gains holding period in months for which mutual fund capital gains distributions qualify for tax purposes. For example, an entry of "12" would mean that the transaction qualifies for the tax rate in the tax rate table which has "12" in the Hold Period field. This methodology provides the flexibility to deal with future changes in the tax laws.

No AutoCalc Calc - Suppresses recomputation of any fields containing manual entries, allowing entry of quantities and amounts which are reverse of normal for a given TAC.

Perturbed - CT/net normally sets and clears this flag to control recomputation of balances, est. taxes, and valuations. You can manually set this flag on an earlier transaction if you want to force subsequent relevant records to be recomputed.

Optional Fields

These fields may be added to the transaction display by using the View/Create/Manage Views command:

Acct Id - If an account's portfolio records contains data from more than one custodian or broker/dealer, you can use this field to differentiate transactions occurring at different broker/dealers or custodians. This feature is only optionally available at the Pro-3 or higher level of the software.

C/M - Designates whether the transaction occurred in a cash or margin sub-account, as one may need to do if you are a broker/dealer handling margin accounts. This feature is only optionally available at the Pro-4 level or higher.

Strategy - This field allows you to assign a transaction to a particular investment strategy within a portfolio. This feature is only optionally available at the Enterprise level or higher.

Price Factor - This field contains the price factor used to compute amount from quantity and price. This is normally pre-filled from the Security ID records and thus does not need to be displayed.

Wash Sale Id - This field contains a numeric identifier used to match wash loss sales with the triggering re-purchase transaction. You should only need to view this field if you have many trades subject to the IRS "wash loss" rule.

Settle Days - This field (available on Pro-3/higher versions) allows tracking of settlement of buy/sell transactions.

Multi-currency fields

These fields are needed for multi-currency transactions, and can be added using the View/Create/Manage Views command or by using the View/Select View command and selecting the "MC" option:

Local Amount - This field contains the transaction net amount denominated in the transaction security's currency.

Exchg. Rate ("X-Rate") - This field specifies the currency exchange rate needed to convert the Local Amount to the portfolio's base currency. If the transaction involved an actual exchange of currency, the exchange rate used should be specified in this field, otherwise the end-of-day exchange rate between the portfolio base currency and the security currency is appropriate.

Aux. X-Rate - This field is used to specify the exchange rate to be used to convert the cost basis specified in the Aux Amount field for RCV transactions back to the currency denomination of the security.

Local Flags - These fields ("Commission Local", "Trade Fees Local", etc., indicate whether the associated field is denominated in the local currency (as opposed to the account base currency).