|

Tax Rates |

|

|

|

|

Tax Rates |

|

|

Tax Rates

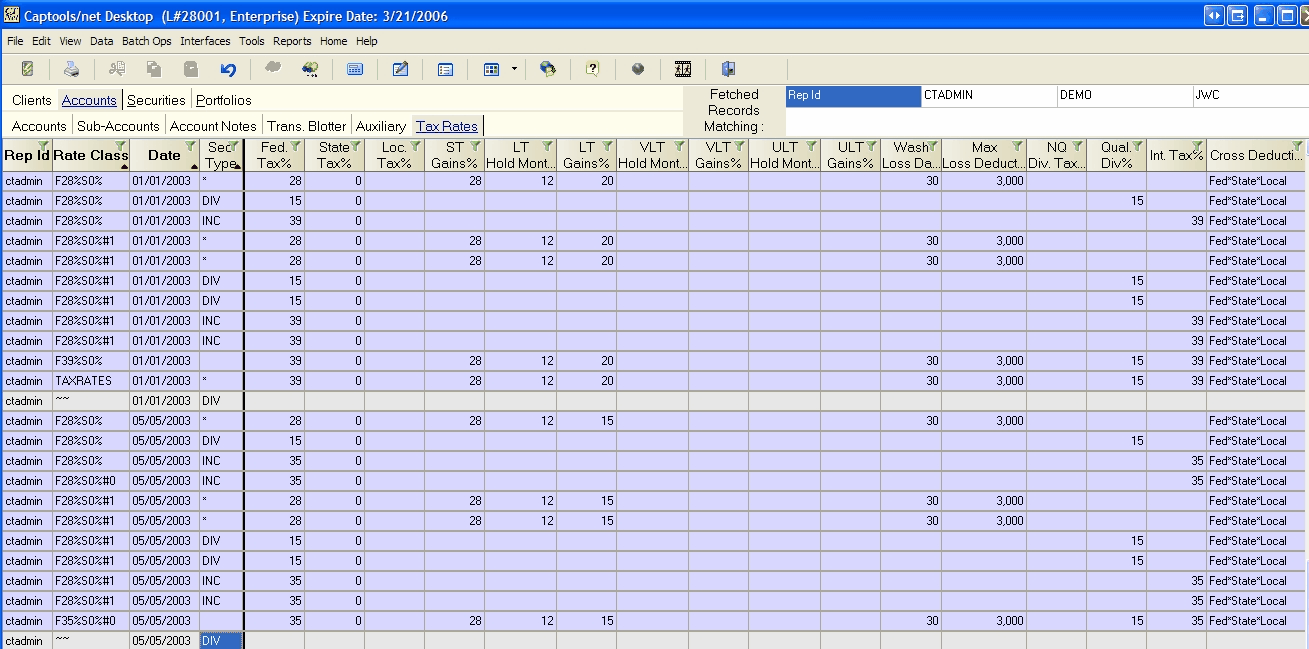

Tax Rate records permit you to specify "Tax Rate Classes" which define, for a given period of time, what tax rates and classifications are applied to portfolio transactions. These records appear as follows in the grid view:

The Tax Rate record fields operate as follows:

Rep Id - This field ensures that you see only tax rate records that belong to accounts whose clients you manage. This is a required field.

Rate Class - This identifies the Tax Rate Class assigned to the record. When computations are performed, the record is looked up using the rate class assigned to the client record to which the subject portfolio is assigned. Assignment of rate classes to accounts is discussed further below.

Date - This field specifies the date on which the tax rate record took effect. When computations are performed the date of the portfolio record is used to find the applicable tax rate record by matching the Rep Id and Rate Class and then using the date to find then closest preceding record.

Sec. Type - This field can be used to indicate that the tax rate record applies only to a particular security type.

Fed. Tax Rate - This is the tax rate, specified as a percent, applied by the federal tax authorities on "ordinary income".

State Tax Rate - This is the tax rate, specified as a percent, applied by state or provincial tax authorities on "ordinary income".

Loc. Tax Rates - This is the tax rate, specified as a percent, applied by local (county & city) tax authorities on "ordinary income".

ST Gains Rate - This is the tax rate, specified as a percent, applied at all levels on realized capital gains held less than the minimum hold period specified in the next field (LT Hold Months). If you specify a State or Local rate this will be added on to this rate.

LT Hold Months - This is the hold period, in months, required for realized capital gains to be taxed at the "long term" rate, specified in the next field.

LT Gains Rate - This is the tax rate, specified as a fraction, applied at all levels on realized capital gains greater than or equal to the minimum hold period specified in the next field (LT Hold Months). If you specify a State or Local rate this will be added on to this rate, unless you specify an override State and Local Capital Gains rates as indicated below in the "Keywords" field, in which case that rate is "additive" to the rate in this field. If you have "included" federal, state and local rates in this number, then you should specify "StateCG%=0" and "LocalCG%=0" in the Keywords field.

VLT & ULT Hold Months - These fields specify the hold periods for "very long term" and "ultra long term" holding rates specified in the following fields.

VLT & ULT Gains Rates - These fields specify the tax rate for realized gains held for the periods specified in the preceding VLT & ULT Hold Months fields.

Wash Loss Days - This specifies the days which must pass before a security sold for a loss may be repurchased without disallowing the loss for tax purposes.

If this value is non-zero, and if the account preferences do not indicate to disable "wash loss" accounting, then cost basis adjusting transactions will be generated when estimated taxes are computed for transactions subject to the wash loss rule.

Max Loss Deduction - This specifies the maximum loss that can be deducted in a tax year.

NQ Div. Tax Rate - This specifies the tax rate on dividend transactions which use the "NQD" or "NQR" transaction codes or which otherwise do not qualify for the "Qualified Dividend Tax Rate" (next field). This is a "combined" rate, meaning that if the federal rate is 28% and the state rate is 5% and local rate is 1% then 34% should be specified.

Qual. Div Tax Rate - This specifies the tax rate on dividend transactions which use the "DV+", "DRI" or "DVW" transaction codes and which otherwise do not dis-qualify for the "Qualified Dividend Tax Rate" (e.g. money market funds). This is a "combined" rate,

meaning the rate should be the sum of federal, state and local rates.

Int. Tax Rate - This is the tax rate applied to interest transactions. This is a "combined" rate, meaning the rate should be the sum of federal, state and local rates.

Cross Deductions - This field permits you to specify whether taxes at various governmental levels are deductible at other levels. If they are, this lowers the effective tax, sometimes by up to 10%. Is "None" is specified no cross-deductions are assumed. You should use "None" if you will be including the cross-deduction effect in the federal, state and local rates that you specify.

Apply CP Index, CPI Symbol, Min CPIndex Hold (custom view)- These field allows you to specify that cost bases for computing realized gains taxes be increased by an inflation index (Consumer Product Index), which is looked up in the price records, using the symbol specified in the CPI Symbol field, provided the asset has been held for the minimum period (months) specified in the Min CPI Hold field. These fields should be left blank for U.S. taxpayers.

Keywords - This field is used for miscellaneous specifications to augment those in the fields above. These use special notations as follows:

StateCG%=6 (specifies the state tax rate on Long Term Capital Gains).

LocalCG%=2 (specifies the local tax rate on Long Term Capital Gains)

Tax Rate Class Usage

The tax rate class field allows you to assign tax rate records for each client under management, or alternatively define a few broad tax rate classes, based upon tax bracket, which are more easily maintained.

Tax Id Tax Class - To assign each client their own tax rate, simply place each client's tax id in the Tax Rate Class field in the client's record, or just place the notation "TAXID" in that field. Tax computations will then search for tax rate records containing the Tax Id in the tax rate record "Rate Class" field. This method has the advantage of allowing the client's tax rates to change over time based not only on tax rate law changes, but based upon changes in tax bracket due to increasing (or decreasing) income. Thus if you recompute taxes for a prior period, the tax rates in effect for that client at that point in time will be applied. The disadvantage of this method is that is requires separate tax rate records for each client and thus more data maintenance.

Tax Bracket Class - This method involves setting up one tax rate record per tax bracket as defined by the tax law at any one time. We've used this method to define the brackets "TOP", TOP-1, TOP-2, TOP-3, etc., using U.S. tax rates in sample data shipped with the software. Thus under this scheme you can assign "TOP" to a client in the highest bracket without maintaining separate records for that client. This scheme works particularly well if your clients are unlikely to change tax brackets, which is often the case. Its chief advantage is requiring less tax record maintenance.

Tax Deferred Accounts

Accounts which are tax deferred will have taxes computed at a zero tax rate, except for withdrawal transactions, which will have estimated taxes computed at the client's ordinary income tax rate.