|

Tax Lots and Cost Bases |

|

|

|

|

Tax Lots and Cost Bases |

|

|

Tax Lots and Cost Bases

Captools/net uses the tax lot number, along with the security symbol, to match buy transactions with sell transactions and to match short sale with cover transactions in computing capital gains. Depending upon tax lot assignments, cost bases are computed on an average cost (single category), a first-in, first-out (FIFO), or a tax lot-specific basis. Multi-category average costing and last-in, first-out (LIFO) costing of transactions are also permitted. If no tax lot numbers are assigned, single-category average costing is assumed (see below).

Tax lot numbers cannot be manually entered in the Lot field of "opening" transactions (e.g. BUY, BYD, RCV, SLS, etc) at the time the transaction is initially entered. However, when a closing transaction (e.g., SLL, SLW, BYC, DLV, RPY) of the same symbol is entered, the corresponding opening transaction is automatically assigned the appropriate tax lot based upon the Security Id and Account record preferences for the default tax lot method. These automatically assigned tax lots can be manually overridden or you can override them by using the "Generate Tax Lot" command discussed later in this chapter.

Tax lot numbers must be used consistently for each security. That is, if you select a particular methodology for a particular security, you must stay with that method for that security until you have closed out all your portfolio holdings in that security. If you later buy more shares after closing earlier holdings, then you can use a different tax lot methodology.

Not all tax lot methodologies are allowed by tax authorities, and some methodologies may be limited to only certain types of securities. Please consult with your tax advisor, if you have any questions about the validity of the tax lot assignment method you plan to choose.

Setting Default Tax Lot

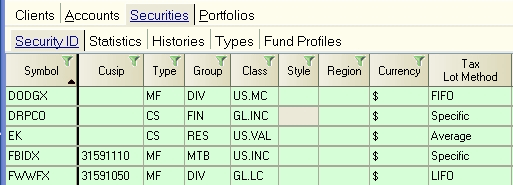

Both the Security Id and Account records contain fields to specify a default tax lot methodology (see Security ID's and Client/Account Edit View) to be used for a closing transaction.

If a closing transaction pertains to an open position in a security which has not previously been assigned a tax lot methodology, the tax lot method will be taken from the method specified in the Security Id record:

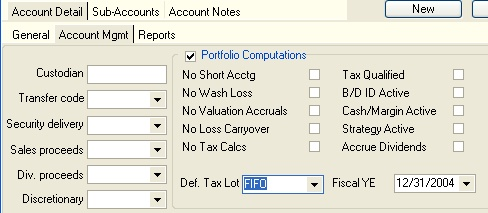

If the Security Id Tax Lot Method is blank or "unassigned", default tax lot methodology specified in the transaction's account record will be used (account "edit" view shown below):

If a closing transaction pertains to opening transactions which have already been assigned a tax lot methodology, that tax lot methodology will be continued until the open position in that security is closed out.

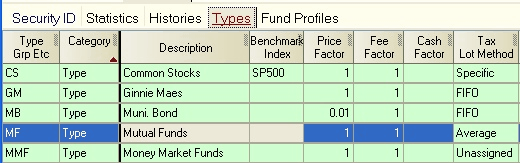

If you would like an entire type of security to be assigned a tax lot methodology, you can specify that in the security "Types" records and any new Security Id record of this type will be assigned this tax lot methodology:

In this example, new securities of type "MF" will be assigned a default tax lot of FFO and new securities with type "MB" will be assigned "Average".

First-In, First-Out Cost

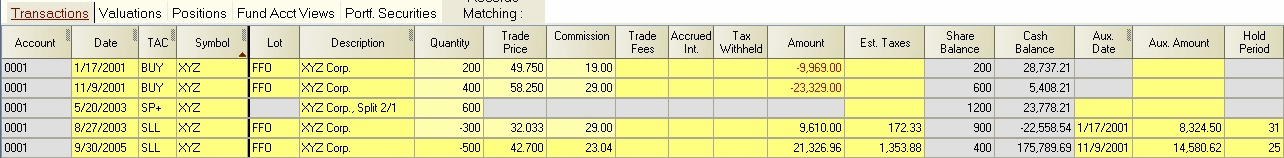

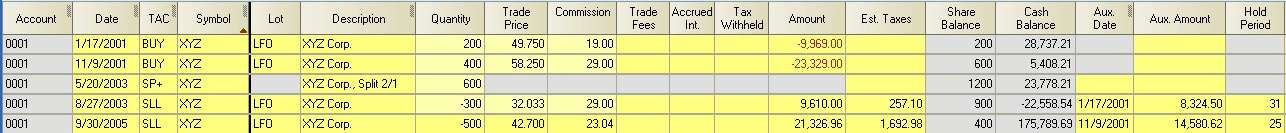

Cost bases are computed on a First-In, First-Out or "FIFO" basis if the FFO tax lot notation is used for successive BUY, SLS, DRI, IRI or CGR transactions for a given security. This approach, or average cost, is required for U.S. taxpayers, if acquisition dates are not indicated on your brokerage confirmation slip when you sell a security. An example of FIFO tax lot assignment is as follows:

To be consistent with prior versions of Captools, FIFO cost is also computed if you re-use the same numeric tax lot number for successive BUY, BYD, DRI, CGR, SLL and/or SLW, transactions. We recommend, however, that repeating numeric tax lots not be used because it may not be supported in future versions of the program.

If you use the FFO notation to indicate FIFO tax lot treatment for a particular security, you must continue to use FFO for all subsequent transactions requiring tax lot numbers for that security, until the position in the security has been closed out. Do not mix FFO with other tax lot numbers for a given security.

Specific-Lot Cost

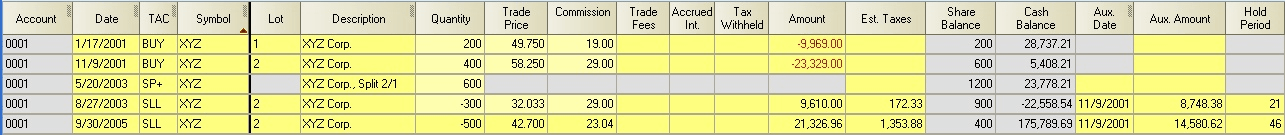

Specific-Lot Cost means that each closing transaction is matched up with a specific opening transaction by tagging each with the same "lot number". This has the advantage of allowing sales to be matched against purchases in a way that delays the recognition of taxable gains and accelerates the recognition of taxable losses. Captools/net implements the automatic assignment of specific lot methodology by assigning a positive integer to each transactions such that each closing transaction is matched to a corresponding opening transaction so as to minimize estimated taxes for each closing transaction.

Specific tax lot numbers up to "999" may be assigned. The same lot number should generally not be re-used for a given security, however, it is acceptable to use the same lot number for different securities.

Advisory: The U.S. Internal Revenue Service requires that users of specific-lot costing be able to back up their tax lot assignments with printed sell trade confirmations indicating the matching purchase dates. Because of this rule, specific-lot costing is normally used only with individual securities rather than with mutual funds. Prior to making a sale, you can enter the anticipated sale into Captools/net to let it determine the most tax-effective tax lot assignment. That assignment then should be specified to the broker when placing the trade.

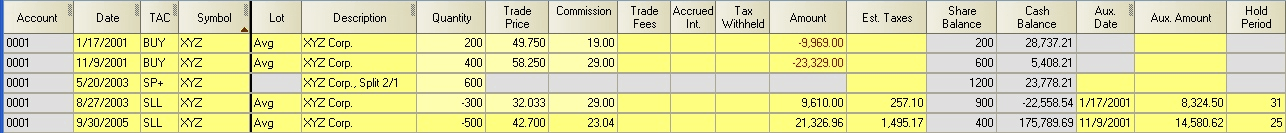

Single-Category, Average Cost means that the cost of a sold share is assumed to be the average cost of all shares remaining prior to the sale. This method is required by Canadian tax law and is generally allowed for U.S. taxpayers for mutual fund holdings. Tax-wise, Single-Category, Average cost is generally a more favorable method to use than FIFO for a sale of shares acquired in a rising market. Single-Category, Average cost is denoted by using the Avg tax lot notation as shown in the following example:

This method computes taxable cost basis using the average cost of all units held at the time of a sale transaction, regardless of holding period. Units which are sold reduce the total cost basis by this average cost multiplied times the number of units sold. This method is called "single category" because there is no distinction between units held short and long term. It is also sometimes known as a "rolling average cost".

Double-Category Average Cost

Under U.S. tax laws, it is sometimes advantageous for mutual fund holders to use average costing, but break the average grouping into short and long term categories. This is often referred to as Double-Category, Average-Cost. Additionally, some non-U.S. taxpayers may also have to comply with tax laws which specify groupings of two or more categories based on holding period.

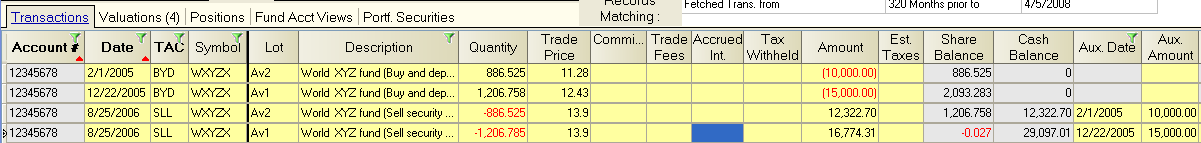

Double-Category, Average costing can be implemented by using the tax lot designators Av1 and Av2. These permit average costing within separate groups for a given security as in the following example:

In this example, it is assumed that any shares held less then one year are short term and are placed in the Av1 category. Any shares held longer than one year are considered long term and are placed in the Av2 category. Note that in order to properly account for the multiple sell transactions, the original purchase had to be broken into two separate transactions, as was the final sale.

The need to often split both opening and closing transactions makes multi-category tax lot accounting messy. Multi-category average costing should generally be avoided unless significant tax saving benefits can be realized through its use.

Last-In, First-Out Cost

A Last-In, First-Out (LIFO) tax lot treatment means that the most recently purchased remaining shares are the ones considered sold whenever shares are sold. LIFO treatment is implemented by using the notation LFO in the tax lot field.

LIFO costing will generally produce more favorable tax treatment than Average or FIFO costing in rising markets. It also does not require breaking a sell or closing transaction into many components in order to achieve matching as does the Specific-Lot method. LIFO treatment is particularly attractive for use with mutual funds. U.S. taxpayers who wish to implement the LIFO method should consult with their tax advisor as to whether they may use LIFO costing.

Blank Tax Lots (Careful!)

If empty or "blank" tax lot numbers are assigned to all purchase/sale portfolio transactions for a given symbol, Captools/net will compute cost basis on a rolling FIFO (first-in, first-out) basis.

If tax lot numbers are assigned to some purchase/sale transactions for a given symbol, and other purchase/sale transactions are left blank, then incorrect costs may be assigned to closing transaction and in cost fields in reports. It is thus important that the user apply consistent usage of tax lots in Captools.

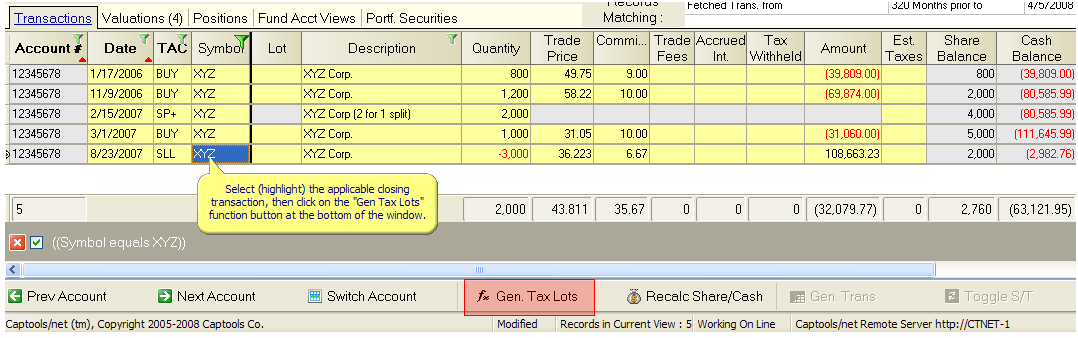

Captools/net will automatically assign tax lots upon entry of closing transactions provided that you have specified a "default" tax lot methodology in the security record and/or the account record. However, there may be some cases where you want to override the assigned tax lots or compare the tax impact of various tax-lot assignment methods. This is most easily done by using the Generate Tax Lots function. This function is invoked by first locating the cursor on the closing (sell or "short covering") transaction for which tax lots are to be assigned and then by clicking Gen Tax Lots button on the special command toolbar appearing at the bottom of the transaction screen:

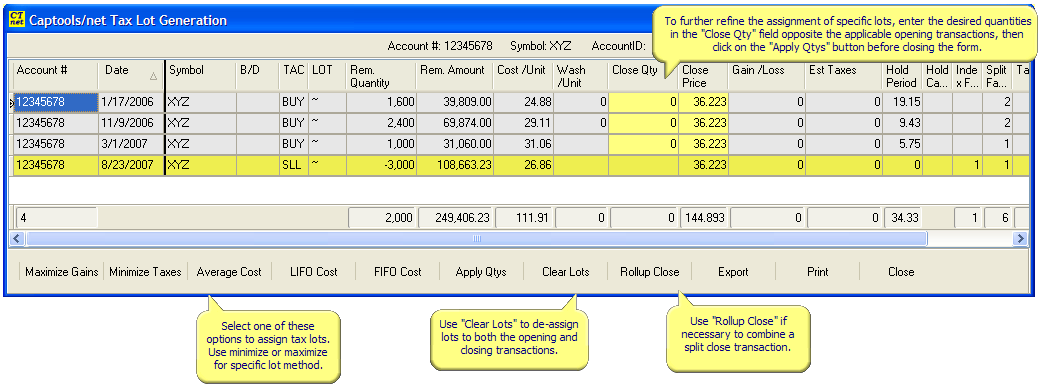

Consider the following set of transactions involving multiple purchases and the subsequent sale of stock shares. In this example, tax lot numbers have not been assigned to the security in advance. Upon execution of the Gen Tax Lots command, with the cursor located on the closing SLL transaction, Captools computes and displays those tax lots for which there are open shares in a special view which appears in a window on top of the transaction table:

The data fields on this screen are interpreted as follows:

Date - Date the security was purchased (or sold short) for this tax lot.

TAC - Transaction code for the tax lot opening transaction.

Lot - Current Tax Lot assignment, taken from the transaction records.

Rem. Quantity - Remaining shares left in the tax lot. This will not necessarily be the same number of shares that were originally purchased. It may be fewer shares if some shares have already been sold, or it may even be more shares if there was a stock split or share dividend subsequent to the original purchase.

Rem. Amount - Remaining cost basis for the tax lot. This may be less than the original cost basis, if some shares have already been sold.

Cost/Unit - Rem. Amount divided by Rem. Quantity.

Wash/Unit - Any adjustment to the cost basis for these shares due to their having been acquired within the "Wash Loss" period after sale of shares for a loss. (This value will always be zero if you take care to avoid purchases in the wash loss period).

Close Qty - This field is where Captools matches up shares sold with shares purchased. Initially it will be blank. You can manually enter share quantities to make the assignment, or you can use the Lot command, discussed below, to have Captools make the assignment.

Close Price - This is the trade price taken from the closing transaction which was selected when you executed the Gen Tax Lots command.

Gain/Loss - This is the taxable gain or loss resulting from the share tax lot assignments.

Est. Taxes - This is the estimated tax impact as a result of the tax lot assignments. You will usually want to make an assignment that will minimize this amount.

Hold Period - This is the period elapsed, stated in months, from each opening transaction to the closing transaction, shown at the end of the list.

Hold Category - This is the hold category for the opening transaction, based upon the categories defined in the applicable tax rate records.

Index Factor - This is the applicable indexing factor, computed based upon CPI Symbol specified in the applicable tax rate records. (This is only applicable if your tax laws permit cost basis indexing..this is not applicable for U.S. taxpayers).

Split Factor - This is the factor used to adjust original opening transaction share quantities to be equivalent to the closing share quantities. Dividing the Rem Quantity by the split factor will give you the original opening transaction quantity.

Executing one of the commands on the bottom of the Tax Lot Generation table performs actions as follows:

Maximize Gains - This assigns "specific" tax lots, indicated by a number greater than zero, to the opening transaction, such that the realized gains are maximized. This method is sometime desired if you have a large loss carryover from prior years which you want to work off. Upon closing the view, the closing record will be split into more than one transaction if there is more than one opening transaction assigned.

Minimize Taxes - This also assigns "specific" tax lots, indicated by a number greater than zero, to the closing record and to the matching opening records, such that the taxes on realized gains are minimized. Although in most cases this is the same as minimizing gains, in some cases taxes will be lower if larger gains, but with a longer holding period are selected. Upon closing the view, the closing record will be split into more than one transaction if there is more than one opening transaction assigned.

Average Cost - This assigns the "AVG" lot identifier to all opening lots dated prior to the closing transaction, to indicate the average methodology is to be used in computing the cost basis. The cost basis is then computed and assigned to the closing transaction in the "Aux. Amount" field.

LIFO Cost - This assigns the "LFO" lot identifier to all lots dated prior to the closing transaction, to indicate the that the last-in, first out methodology is to be used in computing the cost basis. The cost basis is then computed and assigned to the closing transaction in the "Aux. Amount" field.

FIFO Cost - This assigns the "FFO" lot identifier to all lots dated prior to the closing transaction, to indicate that the first-in, first out methodology is to be used in computing the cost basis. The cost basis is then computed and assigned to the closing transaction in the "Aux. Amount" field.

Apply Qtys - This applies any quantities manually assigned in the "Close Qty" field to the underlying closing transactions. This is only applicable if "specific tax lot" numbers have been applied to the opening transactions.

Clear Lots - This removes any tax lot assignments from the current closing record and from any opening transactions linked to it by tax lot. This is necessary if you want to change from Average, Fifo or Lifo methods to the "Specific" method. If want to clear tax lots for all records for a given symbol you will need to repeat this process for each closing transaction.

Close - This closes the tax lot table. Since the data in this view is temporary, it is disposed of and not stored in the database.

Manual Lot Assignment - You may manually assign tax lots in the tax lot table by entering close quantities for each opening transaction displayed. If you choose to do this, however, be careful to ensure that the sum of all close quantity entries equals the value in the Rem. Quantity field of the final record (SLL transaction code in the prior example) on this screen. Once you have finished with the manual tax lot assignment, click on "Apply Qtys" button, and close the view. The tax lot assignments will be transferred to the underlying transactions.

Cost Bifurcation

In 2010, the United States Congress implemented new reporting rules for investment custodians, requiring them to report cost figures on the Form 1099 sent to customers. In conjunction with this, Congress specified that cost basis for average lot costed securities, e.g. mutual funds be "bifurcated" to separate the cost cumulated under the prior law from that reported under the new law. In effect this means that someone holding mutual fund shares that were acquired both before and after the law came into effect would be tracking two average costs, not one average cost.

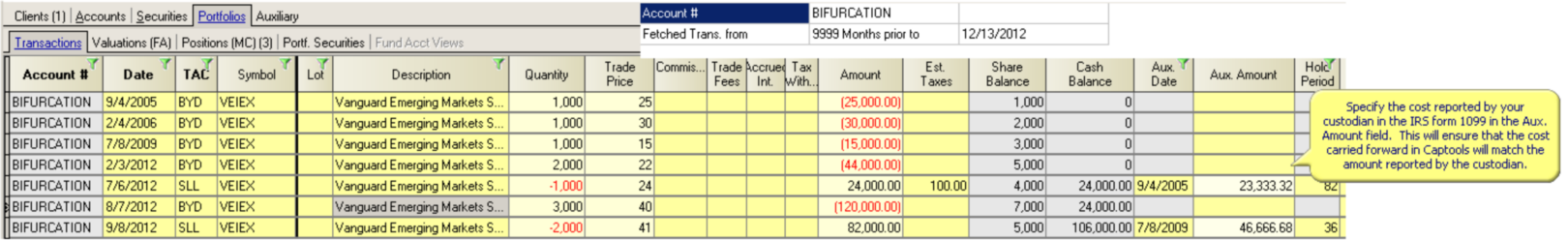

To ensure that your Captools/net cost matches your custodian's cost, simply specify the cost reported by your custodian on the IRS form 1099 in the Captools Aux. Amount field of the sales transaction. This will ensure that the remaining cost carried forward in Captools will match the amount reported by the custodian: