Limited Partnerships, S-Corporations, or direct investments not involving corporate or government securities, may require a number of additional transaction types.

Cash Distributions

These transactions involve the distribution of cash to the investor from the partnership, S-Corp. or other investment entity. These distributions may be taxable in whole, in part, or not at all, depending upon the circumstances of the investment. However, in the U.S., such distributions will usually be non-taxable because the investor, as a partner or S-corp shareholder, is taxed based upon the profit or loss of the business, but not on the distributions to him or her from the business. In Captools/net, cash distribution transactions may take three forms:

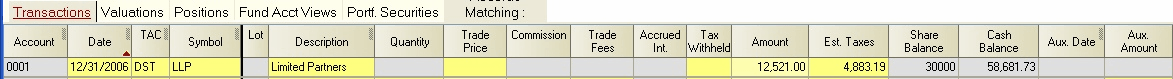

DST - Partnership Distribution (to cash): Use for partnership cash distributions credited to portfolio cash. It is summarized in reports as "Other Income". Use separate entries for taxable and non-taxable portions, with a "0" entry in the Est. Tax field for the non-taxable portion.

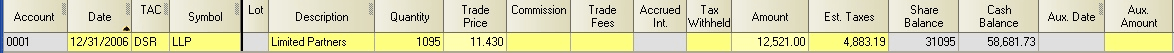

DSR - Partnership Distribution Reinvested (zero net cash change): Use for partnership cash distributions which are reinvested. As with the DST transaction, use separate entries for taxable and non-taxable portions, with a manual "0" entry in the Est. Tax field for the non-taxable portion.

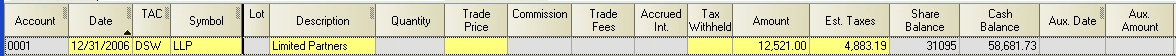

DSW - Partnership Distribution Withdrawn (zero net cash change): Use for partnership cash distributions which are removed from the portfolio, thus leaving the portfolio cash balance unchanged.

Income Distributions

Non-cash accounting transactions are used to pass Partnership or S-corporation profits or losses through to the partners or S-Corp. shareholders to facilitate their tax reporting of such income:

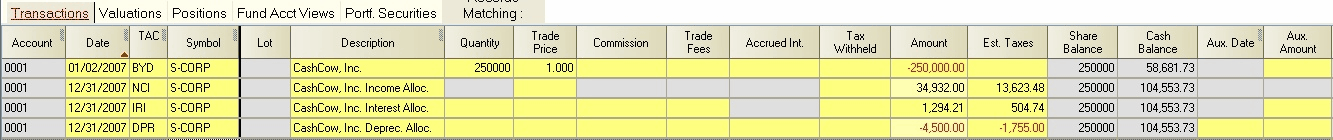

NCI - Non-Cash Income (non-cash transaction): Non-cash distribution are usually reported to the individual via a "K-1" tax form in the U.S. This can be coded as a NCI transaction or broken into more precise categories as follows:

In this case, interest is coded as IRI, but with zero share quantity. This ensures that the associated income is reported in the "Interest" category, but has no effect on shares or cash. Depreciation (DPR) is used in this example to pass depreciation write-offs through to the partner or shareholder. Depreciation reduces taxes and the investment cost basis and is covered further in the next section. Both depreciation (DPR) and non-cash income (NCI) transactions have no effect on cash or shares and are reported in the "Other Income" category, subject to being specified in the report Special Options under "Misc. User Custom Specs" as "+NCI" or "+DPR".

Paid In Capital (Lev. 4)

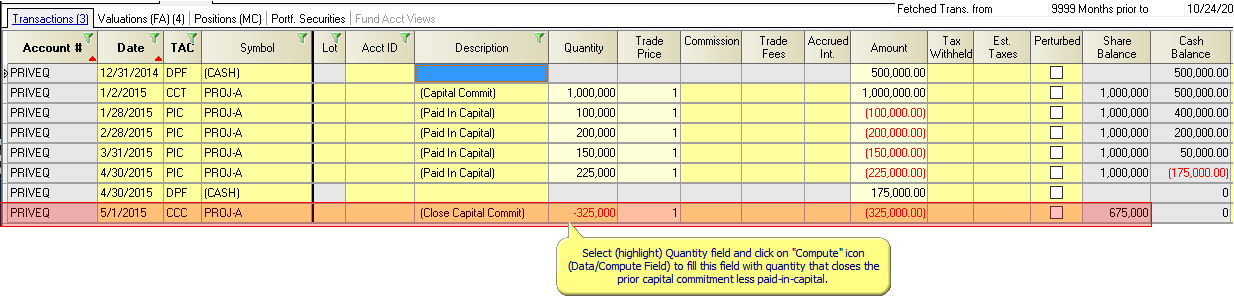

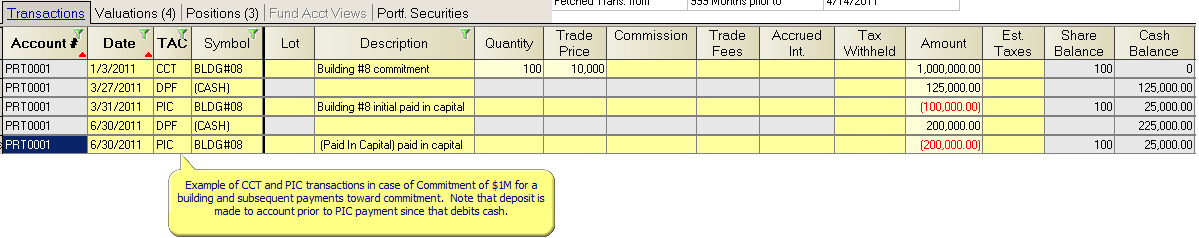

Two transaction related to partnership type investments are "Capital Commit" and "Paid In Capital" which operate as follows:

CCT - Capital CommiT : This non-cash transaction is entered when the account makes a capital commitment (but no cash payment) to the project or partnership. This does not affect cash balances, but allows for accounting and reporting of the commitment which is reduced upon recording of "Paid in Capital" (see below). If the commitment is accompanied by an allocation of partnership units in conjunction with the commitment, these units should be recorded in the "Quantity" field. If in fact a cash payment is made for partnership units, a "BYD" or "BUY" transaction should be used rather than a CCT transaction.

PIC - Paid In Capital : This cash transaction is entered when the account provides a cash investment into the project or partnership, typically in fulfillment of a Capital Commitment. A symbol should be used, but no quantity since it is assumed that this does not result in additional partnership units (use a "BYD" or "BUY" if units are issue with the payment).

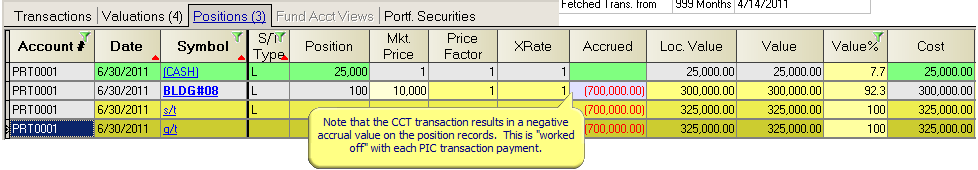

Note that the CCT transactions result in a negative accrual amount on the position table. This is worked off as paid in capital transactions are entered:

CCC - Close Capital Commitment: This non-cash transaction is used to close out initial Capital Commitment transactions which for whatever reason may not be matched by subsequent paid in capital (PIC) transactions. When you enter a CCC transaction and reach the Quantity field, highlight that field and click on the "compute" icon (or Data/Compute Field command) to fill this field with the appropriate quantity. That quantity will be computed from the position record of the most recent prior position record, and will ensure that no more capital commitment is carried for the investment.