|

Real Estate / Depreciation |

|

|

|

|

Real Estate / Depreciation |

|

|

Real Estate / Depreciation

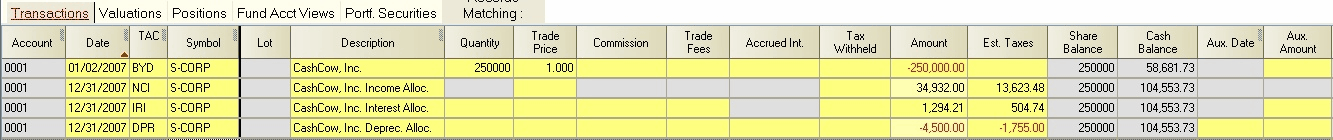

Real estate investments are similar to partnerships and S-corporation investments in that they will often involve non-cash income and depreciation transactions and also "distribution" transactions. Captools/net includes, however, a number of transaction codes, indicated below, specifically suited for real estate investments.

BRW - Borrow of Funds (to cash): Use for transactions involving borrowing of funds, such as a mortgage to finance a real estate acquisition. The BRW and repay (see below) transactions are essentially the reverse of a purchase and sale of a bond. They are also similar to SLS and BYC transactions in that a "security" (promissory note) is "sold" in exchange for cash, and then the note is later purchased back to close out the loan. Interest paid at the time of the borrow transaction, e.g., "points", may be entered in the Accrued Interest field. Use of the BRW transaction is shown in the example below of a real estate investment.

RPY - Repay Funds (from cash): Use to close out a BRW transaction. In the case of a mortgage, RPY is used whenever principal is paid off. Any associated interest payment may be entered in the Accrued Interest field, in which case the Amount field shows the combined principal and interest payment. RPY transactions require lot numbers which match the associated BRW transaction if there is more than one borrow transaction with the same symbol. Use of the RPY transaction is shown in the example below of a real estate investment.

RNT - Rent Received (to cash): Use to indicate rent receipts from an asset. It functions similar to a DV+ or IN+ transaction. Rent income is reported under the Other Income category. Use of the RNT transaction in connection with a real estate investment is shown in the example below.

EXP - Expenses Paid (from cash): Use to indicate expenses associated with a particular asset (use a symbol) or the entire portfolio (cash symbol). Use of the EXP transaction in connection with a real estate investment is shown in the example below.

DPR - Depreciation (non-cash, reduces cost basis): Use for depreciation on an asset. DPR transactions do not affect portfolio value, cash balances or before-tax ROI. A negative DPR amount (typical) decreases an asset's cost basis and reduces taxes until the investment is sold, at which time the depreciated amount becomes a part of taxable capital gains. A positive DPR transaction (infrequent) can be used to increase an asset's cost basis to reflect capital improvements. Lot numbers are needed for DPR transactions only if they are assigned to the original purchase transaction. Use of the DPR transaction in connection with a real estate investment is shown in the real estate example below.

Real Estate Investment Example - Real estate is one common form of direct investment which may be made by individuals or by limited partnerships. Over the course of a real estate investment, a number of different transactions are used. The following example shows use of the BRW, RPY, RNT, EXP and DPR transaction codes along with asset purchase and sale transactions.

Although these transaction codes are often used for real estate, they are not limited to this use. With a little creativity, they can also be used in connection with other investments.