|

Buy / Sell |

|

|

|

|

Buy / Sell |

|

|

Buy / Sell

"Buy" transactions represent the spending of portfolio funds in exchange for security shares. This results in a reduction in the portfolio cash balance position. Conversely, "Sell" transactions represent the reduction of security shares in return for payment into the portfolio, thus increasing the portfolio cash balance.

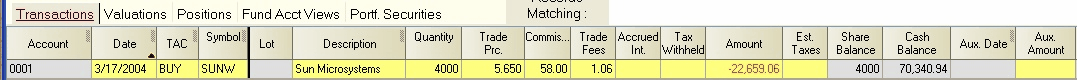

BUY - Buy (payment from cash): Use whenever a security (stock, bond, T-bill, option, etc.) is purchased into the portfolio with payment made by debiting portfolio cash.

BYD - Buy & Deposit (zero net cash change): This transaction combines a buy and deposit funds transaction into a single transaction. Use BYD whenever the buy and deposit occur on the same date, such that the portfolio cash balance is unchanged. This is typically the case for mutual fund and money market fund purchases. An example of a BYD transaction is as follows:

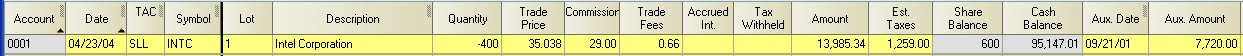

SLL - Sell (proceeds to cash): Use whenever a security is sold from the portfolio, with the proceeds credited to cash. Proceeds can then be moved into a money market fund using a separate BUY transaction.

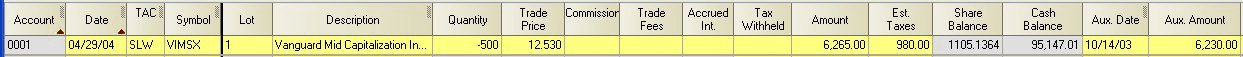

SLW - Sell & Withdraw (zero net cash change): This transaction combines the Sell (SLL) and Withdraw Funds (WDF) transactions. Use whenever the SLL and WDF occur on the same date, such that the portfolio cash balance is left unchanged. This is typically the case when funds are withdrawn from mutual funds or money market funds.

Trade Fees and Est. Taxes - These fields are computed upon selecting the field and executing the "Data/Compute Fields" command or clicking on the "Compute" icon. They are also computed upon posting the record (moving to another record, or tabbing out of the view, or executing "File/Save"). Trade Fee computation requires that the security note history records contain an entry for "SEC_FEE" (see SEC Fees for detail). The Est. Taxes computation requires that the account have a tax rate class assigned and one or more entries for that rate class appears in the Tax Rates table. See Tax Rates for more detail.

Accrued Interest - This field generally only needs a value if the security is a bond and the transaction is some form of buy transaction occurring on a date other than the original issue date or a sell transaction occurring on other than the maturity date. This field can be computed by executing the "Data/Compute Fields" command or clicking on the "Compute" icon when the field is selected.

Tax Lots - Closing transactions (e.g., SLL, SLW, BYC, DLV, RPY) must have symbol and tax lot number combinations which match earlier opening type transactions (e.g., BUY, BYD, SLS, RCV, BRW, DRI, IRI, CGR, etc.). This is to permit the security cost basis to be properly adjusted. Tax lots are automatically assigned at the time that the closing transaction is entered, based upon the default tax rate method specified for the portfolio or the security. This assignment may be manually overridden using the tax lot assignment command implemented via a button appearing at the bottom of the portfolio view:

![]()

There are a number of different tax lot methods which can be used. See Tax Lots and Cost Bases, for more details on proper tax lot usage, and implementation of the tax lot assignment command.

Aux. Date and Aux. Amount - These fields contains the purchase date and cost basis amount for SLL and SLW transactions. Its value is automatically computed when tax lots are assigned. See Tax Lots and Cost Bases for more details on this subject.

Options and Futures - On opening transactions for option and futures contract securities, the Aux Date and Aux Amount fields contain, the contract date and strike price for the security, with the appropriate values normally pulled from the security record for the security. See the topic Options/Futures/CFDs for more details.

Foreign Cash Accounting - If you have multi-currency accounts and have selected Captools/net's "Foreign Cash Accounting" for these accounts you need to use "BFC" (Buy Foreign Currency) and "SFC" (Sell Foreign Currency) transaction codes to move money between the account base currency and the other foreign currencies. See examples for these codes at Other Transaction Codes.