|

Capital Gains Distributions |

|

|

|

|

Capital Gains Distributions |

|

|

Capital Gains Distributions

Capital Gains Distributions are payments received by the portfolio, usually in connection with mutual funds held by the portfolio. These payments represent the mutual fund shareholder's portion of capital gains that were realized by the mutual fund over a specific period. Occasionally, but rarely, capital gain distributions may also be paid to corporate shareholders when a corporation divests an asset at a profit and decides to distribute rather than retain the gain.

Captools/net provides for both short and long categories of capital gains distributions. Your mutual fund company will generally identify to you whether a capital gains distribution requires short or long term tax treatment. Under recent U.S. tax laws, long-term gains have varying tax rates depending upon the length of the holding period. The holding period should be specified in the Hold Period field in CGD, CGR and CGW transactions to indicate the applicable rate to be used from the portfolio's tax rate table. See Tax Rates in Chapter 9 for more detail.

Capital gains distributions are reported on the Income report in its separate category (you can note this fact in the "User Text" area in the Realized Gains report if you issue such a report).

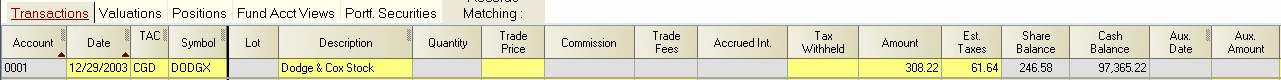

CGD - Long Term Capital Gains Distribution (to cash): Use when a long term capital gains distribution is received, such as from a mutual fund. Long term capital gains distributions are taxed at long term capital gains rates.

Hold Period - The hold period field can be used to specify that a CGD, CGR or CGW transaction is qualified for taxation at a different rate than the normal "Long Term" rate. For example, if a distribution is for gains on securities held more than 5 years or 60 months, you would enter "60" in the "Hold Period" field to indicate this qualification.

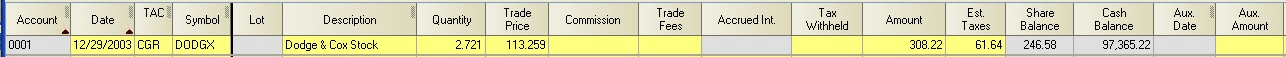

CGR - Long Term Capital Gains Distribution Reinvested (zero net cash change): Use for a reinvested long term capital gains distribution. This transaction is equivalent to entering a CGD transaction followed by a BUY transaction in the same amount.

If you are manually entering CGR transactions, enter the quantity and amount rather than quantity and price or amount and price. This will minimize the chances of rounding differences between Captools and the mutual fund company or other payer of the reinvested distribution. If you enter the price and amount, Captools/net will compute the quantity using the decimal precision specified in the security list record. Although typically not necessary, the "Aux. Amount" field can be used to specify a cost basis for the transaction other than the value in the "Amount" field.

CGW - Long Term Capital Gains Distribution Withdrawn (zero net cash change): Use for a capital gains distribution received, but withdrawn rather than retained in the portfolio. The CGW transaction is equivalent to a CGD transaction followed by a WDF transaction.

SGD - Short Term Capital Gains Distribution (to cash): Use when a short term capital gains distribution is received, such as from a mutual fund. Short term capital gains distributions are taxed at short term capital gains rates.

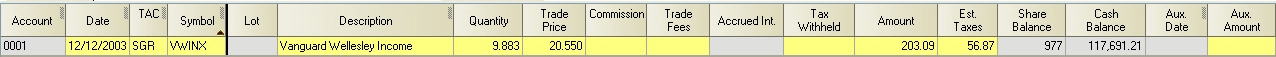

SGR - Short Term Capital Gains Distribution Reinvested (zero net cash change): Similar to the CGR transaction except gets short term capital gains tax treatment.

If you are manually entering SGR transactions, enter the quantity and amount rather than quantity and price or amount and price. This will minimize the chances of rounding differences between Captools/net and the mutual fund company or other payer of the reinvested distribution. Although typically not necessary, the "Aux. Amount" field can be used to specify a cost basis for the transaction other than the value in the "Amount" field.

SGW - Short Term Capital Gains Distribution Withdrawn (zero net cash change): Use for a short term capital gains distribution received, but withdrawn rather than retained in the portfolio.

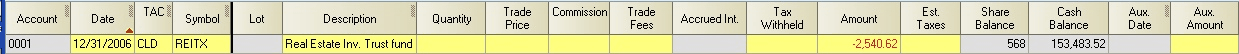

CLD - Capital Loss Distribution (non-cash transaction): Use for long term capital losses distributed by a mutual fund. Negative share quantities are entered if share quantities are reduced, otherwise the Quantity field is left blank as in this example.

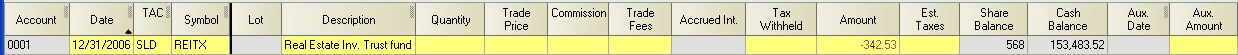

SLD - Short Term Capital Loss Distribution (non-cash transaction): Use for short term capital losses distributed by a mutual fund. Negative share quantities are entered if share quantities are reduced.

Undistributed Capital Gains - A CGR transaction code can be used for undistributed capital gains by entering zero for the quantity and the amount of the undistributed gain in the Amount field. This amount will be added to the cost basis so it is correctly calculated for open lot reports.