|

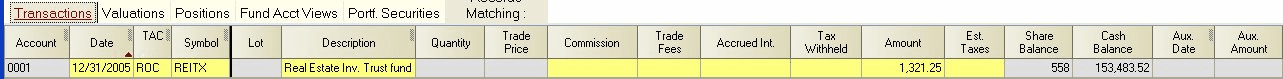

Return of Capital |

|

|

|

|

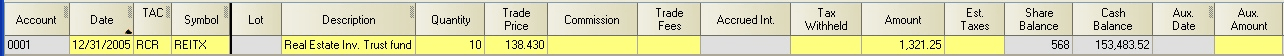

Return of Capital |

|

|

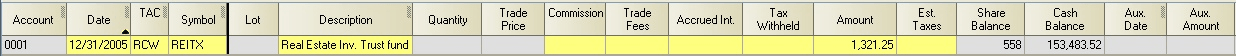

Return of Capital

"Return of Capital" represents payments received from a company which has no accumulated profit on its balance sheet. The payment is assumed to come from investors' paid-in capital and thus is usually not taxed. The payment does, however, reduce the cost basis of the investment. Return of Capital received by mutual funds is usually passed through to mutual fund holders and is usually designated as "Return of Capital" or "Return of Principal" on the fund statement.

ROC - Return of Capital (to cash): Use to indicate return of capital. Cost bases are automatically re-adjusted in capital gains, position and open lot reports for this transaction. Lot numbers can be optionally used to tie the return of capital to particular purchase transactions.

RCR - Return of Capital Reinvested (zero net cash change): Use to indicate return of capital which is being reinvested. If you are manually entering RCR transactions, enter the quantity and amount rather than quantity and price or amount and price. This will minimize the chances of rounding differences between Captools/net and the payer of the reinvested return of capital.

RCW - Return of Capital Withdrawn (zero net cash change): Use to indicate return of capital which is withdrawn from the portfolio.

RCS - Return of Capital with Shares reduced (cash credited): Use to indicate return of capital which is accompanied by a reduction of share units. This might occur for fixed income securities whose periodic payments include a pay down of principal.