|

Dividends |

|

|

|

|

Dividends |

|

|

Dividends

Dividend payments are payments received by the portfolio in connection with equity type securities held by the portfolio. These payments may be from common or preferred stock or shares, or from mutual funds. Dividend payments may also be paid out by the portfolio when dividends are declared on shares held short.

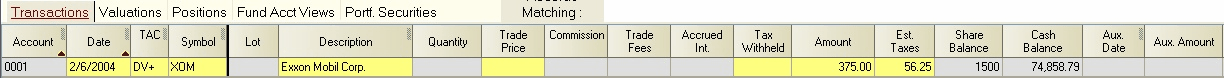

DV+ - Dividend Income (to cash): Use whenever the portfolio is credited with a cash dividend.

If a security has payment dates and rates specified in the Security Id records, and the transaction date matches the security payment date, this field can be computed by executing the "Data/Compute Fields" command or clicking on the "Compute" icon when the field is selected. If the Security Statistic records contain a dividend rate from a recent payment, this will be used in lieu of the rate in the Security Id record.

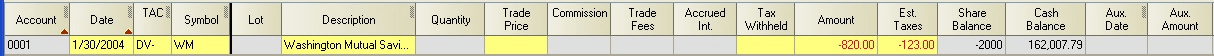

DV- - Dividend Payment (from cash): Use whenever the portfolio is debited for a dividend on shares held short.

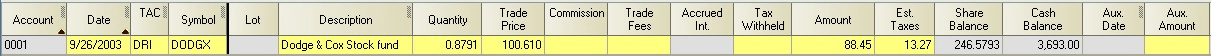

DRI - Dividend Reinvested (zero net cash change): Use for dividend reinvestment. This combines DV+ and BUY transactions and thus requires quantity and amount inputs. The amount value is positive for a long position.

If you are manually entering DRI transactions, enter the quantity and amount rather than quantity and price or amount and price. This will minimize the chances of rounding differences between Captools/net and the mutual fund company or other payer of the reinvested dividend. If you enter price and amount first, the quantity will be computed and rounded to the decimal places specified in the Security Id record "Shr Decimal" field. Although typically not necessary, the "Aux. Amount" field can be used to specify a cost basis for the transaction other than the value in the "Amount" field.

Eventually, each DRI transaction must be closed with a sell type transaction. At that time, tax lot assignments can be made to match the sale transaction with purchase transactions, including dividend reinvestment purchases. See Tax Lots and Cost Bases, for examples of the use of lot numbers with DRI type transactions.

DRIPs - If a dividend reinvestment is made in connection with a U.S. stock dividend reinvestment plan (DRIP), the cost basis of the transaction may need to be adjusted to account for commission avoidance. Normally, you will be notified by the dividend payer of the adjustment required. Enter this by placing the adjusted amount in the Aux. Amount field of the reinvestment transaction.

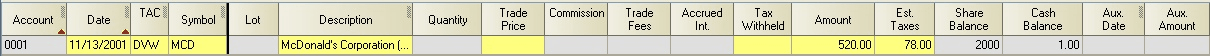

DVW - Dividend Income Withdrawn (zero net cash change): Dividend earned, but withdrawn rather than retained in the portfolio. For example, a dividend check received on safe deposit box shares, where the check is cashed rather than reinvested in the portfolio.

Note that a DVW transaction is the equivalent of a DV+ transaction followed by a WDF transaction.

NQD - Non-Qualified Dividend: Use when dividend is not qualified for a lower tax rate. This is credited to cash.

NQW - Non-Qualified dividend Withdrawn: Use when dividend is not qualified for a lower tax rate, and is withdrawn from the account.

NQR - Non-Qualified dividend Reinvested: Use when dividend is not qualified for a lower tax rate and is reinvested.

OIP - Other Income Paid from custodian: This is typically used when a security owned by an account is loaned out by the custodian to a third party (typically a short seller). The borrower must pay the custodian for any dividends declared on such borrowed holders. Since such payments are not tax qualified, the holder typically will pay a "gross-up" (i.e. more) on the dividend to compensate for the fact that the dividend received by the owner is not qualified. The total payment should be entered with the OIP code, rather than a DV+ or DRI, and will be reported separately.

Interest or Dividend Income Accrual

For many users, Interest or Dividend accruals are supported by Captools computing the accrual amount in the "Accrued" column in the Captools Position records (see Accrued field). This computation is based upon the settings made in the security records and the security distribution records. However, income accruals may also be entered as transactions using the "ACL" transaction code:

ACL - ACcruaL transaction: This transaction indicates that the contents of the "Amount" field is to be cumulated into the downstream Position records "Accrued" field. Unlike the "computed" accrued values, accruals specified in this manner must be reversed, by entering a negative ACL transaction when the cash actual income payment is received into the account.