|

Tax Related |

|

|

|

|

Tax Related |

|

|

Tax Related

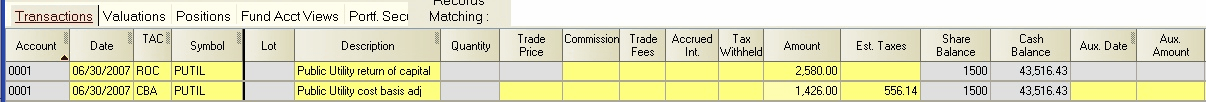

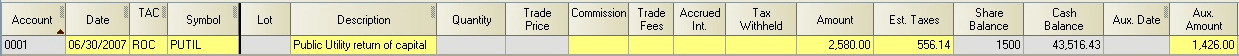

CBA - Cost Basis Adjustment (non-cash transaction): This code is used to adjust the cost basis of a security in a portfolio. Although rare, in some instances such an adjustment may be necessary to maintain consistency with tax laws. For example, a CBA transaction may be necessary to prevent the cost basis of an investment from going negative (not allowed by the IRS) as a result of ROC transactions.

Negative Adjustment - Although the cost basis adjustment in the prior example is positive, in some cases the adjustment will be negative. In these cases, you must explicitly enter the negative sign for the amount field entry.

Cost Basis Adjustment in Aux. Amount - A cost basis adjustment can also be implemented as a part of ROC transactions or reinvestment transactions or opening transactions (DRI, CGR, SGR, RCR, BUY, BYD, SLS, or BRW) by entering the cost basis adjustment amount in the Aux. Amount field. This is the preferred method for handling a cost basis adjustment which is related to a specific transaction.

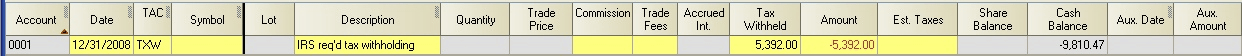

TXW - Tax Withheld (from cash): This code is used to indicate that portfolio cash has been debited to pay for a potential tax liability incurred by the account. If no symbol is specified, or if the cash ticker (CASH) is specified, the tax withheld amount is debited from portfolio cash. Since the withholding of tax is itself not a taxable event, the Est. Tax field will normally be blank:

Since the act of withholding taxes is not itself a taxable event, the Est. Tax field will normally be blank as in this example.

Tax Withheld Field - The TXW transaction should not be used when the tax is withheld in connection with a specific dividend or interest payment received. In this case, the Tax Withheld field should be used to indicate the amount of tax withheld:

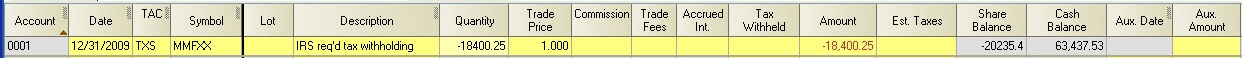

TXS - Tax Withheld (paid from shares sold, zero net cash change): This code is used to indicate that shares of the indicated security have been sold and the resulting funds withdrawn from the portfolio for tax withholding:

If the security sold is not a money market fund, there may be a capital gain or loss incurred on the sale, in which case Captools/net will compute the estimated taxes.

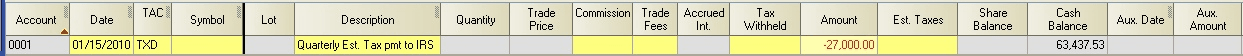

TXD - Tax Withheld (paid from deposited funds, zero net cash change): This code is used to indicate that the owner of a portfolio has paid tax withholding on behalf of the portfolio, by remitting funds from outside the portfolio, typically a check, to pay for the tax. This code has the same effect as a DPF transaction followed by a TXW transaction.

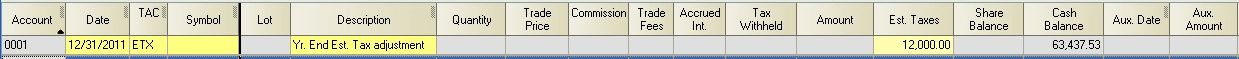

ETX - Estimated Tax Adjustment (non-cash transaction): This code is used whenever a tax adjustment at year-end is needed to force total taxes in the Est. Tax field for the year to equal U.S. Federal Tax Schedule D tax amounts for portfolio capital gains. In particular, it adjusts estimated taxes upward to take into account limits on capital losses that may be recognized for tax purposes in any one year. Entries in the Est. Tax field only affect after-tax ROIs and do not affect portfolio valuation or income reports.

An estimated tax transaction is automatically computed and inserted at year-end during portfolio tax computations, if "Tax Adjustment" is activated in the portfolio preferences.

SCO - Short Term Loss Carryover (non-cash transaction): This code is used whenever a short term loss carryover may be credited to the portfolio (as per U.S. Federal Tax Schedule D). The amount of the carryover is placed in the Aux. Amount field. This transaction is automatically computed and inserted after year-end during tax computations, if the Portfolio Preference for Loss Carryover is activated. This transaction does not affect portfolio cash, but will improve after-tax ROI for the subsequent year.

LCO - Long Term Loss Carryover (non-cash transaction): This code is used whenever tax schedule D indicates a long term loss carryover may be credited to the portfolio (as per U.S. Federal Tax Schedule D). The amount of the carryover is placed in the Aux. Amount field, and the applicable holding period in the Hold Period field. This transaction is automatically computed and inserted after year-end during tax computations, if the Portfolio Preference for Loss Carryover is activated. This transaction does not affect portfolio cash, but will improve after-tax ROI.

TDG - Tax Deductible Gift: This transaction can be used when an asset is removed from the portfolio as a tax-deductible gift. It has the same effect as a "SLW" transaction in terms of ROI, but with an estimated tax computation based upon the entire value of the "Amount" field but with a negative sign (i.e. a tax reduction). See also the Deliver topic.

WCF - Wash-loss cost Carry Forward: The transaction type operated similarly to the CBA (cost basis adjustment) but is reserved only for use in tax wash loss carry forward situations. This type of transaction typically is automatically inserted upon computation of "Estimated Taxes" for a transaction which triggers a Tax Loss Wash situation.