|

Receive / Deliver |

|

|

|

|

Receive / Deliver |

|

|

Receive / Deliver

Receive and Deliver transactions are similar to Deposit and Withdraw transactions in that they add value to or remove value from the portfolio. They are different, however, in that they involve security shares and not cash. (Important!: Do not use RCV or DLV for cash transactions, instead use DPF and WDF).

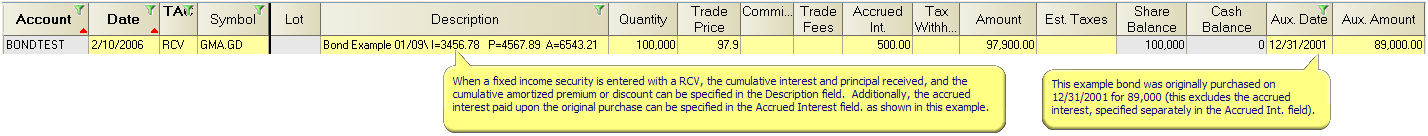

RCV - Receive Shares (non-cash transaction): Use to indicate shares received into a portfolio at no cash cost to the portfolio. Both quantity and amount entries are made, with the amount entry equaling the market value of the security as of the date of the transaction. The original acquisition date and cost basis of the stock should be specified in the Aux. Date and Aux. Amount fields respectively. This enables correct reporting of the security's taxable cost basis and purchase date. For example:

If not specified in the Auxiliary fields, the acquisition date and cost basis are assumed to be the transaction date and amount entries.

Bonds/Ginne Maes, etc. - When an account is initialized using the RCV transaction, interest bearing and/or principal paying securities can have their cumulative interest, principal and amortized/accreted premium/discount specified in the description field as shown in this example (note: use a negative number for cumulative amortization amount, e.g. "A=-5432.10", but a positive number for accretion as in the example below).

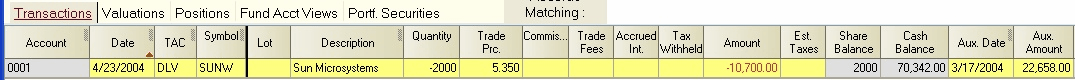

DLV - Deliver Shares (non-cash transaction): Use to indicate shares delivered out of the portfolio. The Amount entry should be the value on delivery date, and the Aux. Date and Aux. Amount, which are normally computed, should contain the cost basis of the delivered shares:

If you maintain ownership of the security in another portfolio, a manual entry of zero is made in the Est. Tax field to suppress reporting on the capital gains report.

The RCV and DLV transactions can be used in combination to indicate the transfer of shares from one portfolio to another. A DLV transaction is entered in the portfolio which is giving up the shares, and a RCV transaction is entered in the portfolio receiving the shares.

TDG - Tax-Deductible Gift (non-cash transaction): This code should be used if shares are removed from the portfolio and given to a tax-deductible cause. It operates in the same fashion as the DLV transaction, except that the estimated taxes are computed as a credit and are computed based upon the full market value of the shares as indicated in the Amount field.

The TGD transaction should not be used if the gift is not tax deductible, such as a gift of shares to a relative. In this case, a DLV transaction should be used with a zero estimated tax.