|

Report Special Options |

|

|

|

|

Report Special Options |

|

|

Report Special Options

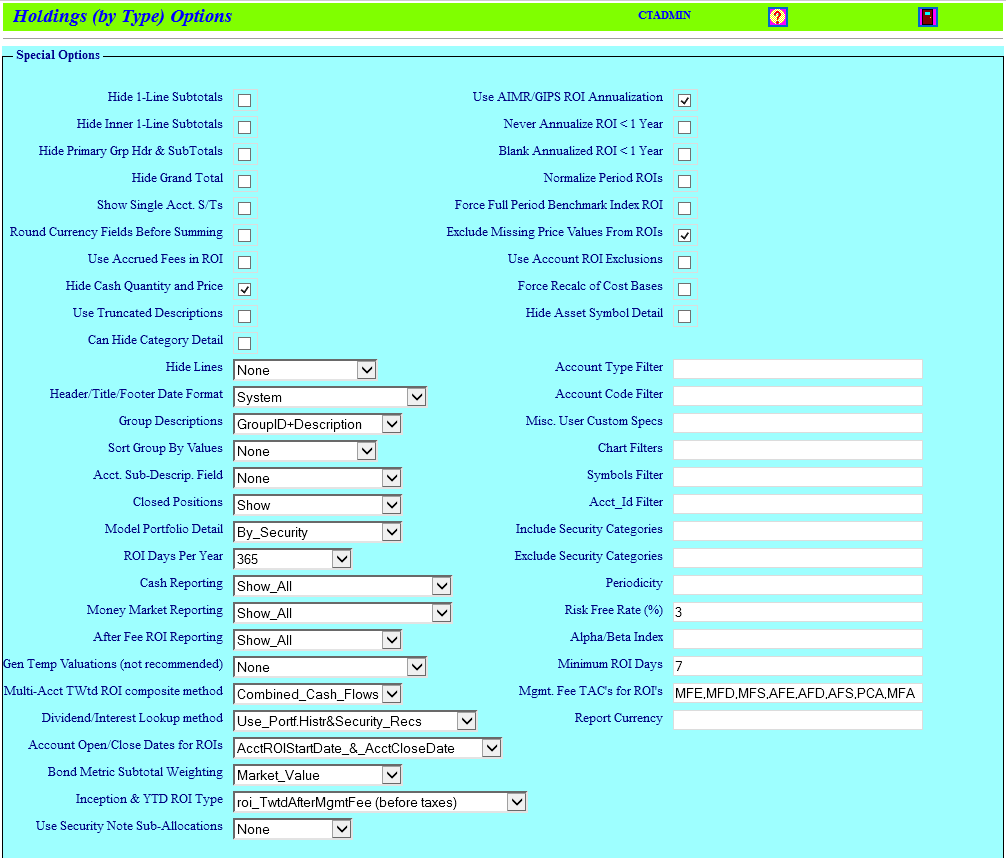

Many Captools/net reports contain report-specific options which control how the report is computed and displayed. These options can be set by clicking on the Edit Report Special Options button on the Report Edit Setup page. The relevant options will vary from report to report, however the following is a typical example of the options available for a common portfolio holdings report:

We attempt to make the report special options self-explanatory. However, more detail on most of the available options is as follows:

Most Reports

Hide One Line Subtotals - When selected, this check box option hides the subtotal line when there is only one associated detail line preceding.

Hide Inner One Line Subtotals - This option works similar to the "Hide One Line Subtotal" but only applies if the subtotal belongs to the innermost group.

Hide Primary Group Hdr & Subtotal - This allows hiding the primary group header and subtotals, which can be useful for some cross-reference reports meant for export, such as Fee Summaries.

Hide Grand Total - This allows you to hide the grand total line independent of the "Hide Lines" setting.

Show Single Account Subtotals - When running a portfolio report against a single account, the account subtotal is usually redundant with the report grand total, and thus is suppressed. This option allows you to specify that it be displayed regardless.

Round Currency Fields Before Summing - This option specifies that the summation of currency fields for subtotals and totals be done by rounding the detail amounts to the specified display precision before summing, so as to ensure that the displayed totals are consistent with the displayed detail amounts, i.e. there is no visually apparent "rounding error" (this is primarily needed for "cost" fields which are stored in the database to more than 1 cent precision, but are typically only displayed to one cent precision). More sophisticated users may recognize this as a "don't care" item since they realize that such small amounts are immaterial in comparison to the amounts that are made or lost in a second of market action.

Hide Cash Quantity and Price - This option displays "cash" type records as "blank" in the quantity and price fields.

Hide Lines - This list selection control allows you to specify whether to hide detail, subtotal or grand total lines in the report or various combinations of those.

Header/Title/Footer Date Format - This permits you to control the reporting date format for the report header, title and footer regions independent of your Captools/net server date format settings. The date format for the report body region can be controlled at the field level when you edit the field.

Group Descriptions - This controls how group descriptions are displayed, i.e. whether only the group field identifier is used or whether a lookup description is included either additionally or exclusively.

Symbols Filter - This control allows you to include/exclude specific securities from the report. To include securities, simply list the symbols separated by commas. If the specified securities are to be excluded, precede the list with a minus "-" sign, e.g. "-(CASH),MMF$". The SQL wildcard characters "_" and "%" can also be used if the filter is preceded by the notation "LIKE=", e.g. "LIKE=MSFT,MSFT%" (e.g. to get symbol MSFT plus options on that symbol).

To temporarily disable or alter a filter without deleting it, precede the filter text to be disabled with '//' (without quotes), e.g. MSFT//,AAPL will have the same effect as removing 'AAPL' from the filter.

Include/Exclude Security Category - If you want your report to include or exclude certain categories of securities, you can use these controls to specify the security "Type", "Group", "Class", "Style", "Region" or "Currency" to do this. Specify the security types, groups, etc., separated by commas, e.g. "MF1,MF2,MF3,CB,MB". For this specification to take effect, the category you use must be a "Grouping" field in the report. Thus if you want to exclude securities based upon the security "Type", the "Type" field must be a grouping field in your report. Also, use of the exclusion and inclusion controls are mutually exclusive. That is, if you specify one or more securities categories for exclusion, the "inclusion" checking will be skipped. The Security Category filters can also be disabled using the "//" characters as for the Symbol filter described above.

Periodicity - This text control allows you to specify that multiple periods be reported within a given report. To specify periodicity, use a whole number followed by "D" for Days, "W" for Weeks, "M" for months, "Q" for Quarters, and "Y" for years, with each period separated by a comma. Periods can be overlapping or contiguous serial periods as follows:

Overlapping - E.g. "5Y,3Y,2Y,12M,1Q" would specify five periods ending on the report end date, with the first period beginning 5 years prior to the end date, the second beginning 3 years prior to the end date, etc., and the last period beginning one quarter (3 months) prior to the end date.

Serial - Use an "S" to specify that serial periods be used, e.g. "1Y,1Y,1Y,1Y,3M,S" would specify 5 periods, the first starting 4 years, three months prior to the report end date and ending 3 years, 3 months prior, and the second period starting 3 years, 3 months prior and ending 2 years, 3 months prior, etc. until the last period begins 3 months prior and ends on the end date.

Inception Date - If the earliest start date specified occurs before the start of a portfolio's inception date, then the inception date is used as the start date of the report. This can be adjusted by adding the notation such as "I+3M" to the periodicity text to specify that the earliest start report date be 3 months after the actual inception date. When Captools/net needs a valuation on the report start date, it will look for the next valuation date equal to or later than the computed inception date.

Period-to-Date - If you want a period to begin at the beginning of the year or quarter and end at the report end date, use the notation "*Y" or "*Q" in the periodicity text. E.g., "1Y,1Y,1Y,*Y" will generate four report periods with the last period starting at the beginning of the calendar year and ending at the report end date.

Base Date - Precede the period specification with "B" if you want the period to start at the base date indicated in the report setup dialog. E.g. the notation "B1Q,B2Q,*Y" will report the first quarter after the report start date, followed the first 2 quarters after the report start date, followed by the year to date period.

Repetitive Intervals - If you want repetitive intervals, such as for the cumulative ROI type report, you can use a notation similar to "1Qx40,S" to indicate you want 40 quarters. The "S" in this example would specify that the periods are serially arranged such that the end of one period is the start of another.

Mixed Overlapping and Serial Periods - Your periodicity specification can mix "Overlapping" and "Serial" periods by specifying the "Serial" notation prior to the periods which are to be in serial order, e.g. "5Y,3Y,S1Y,*Y" would indicate to report starting from 5 years and 3 years prior to the end date, then report two separate years with the 2nd year starting at the end of the prior year.

Date Alignment - Using the notation "EOY" will adjust align periods to Year End, e.g. 5Y,3Y,1Y,*Y,EOY will ensure that period start dates are on a year end, and quarter dates on quarter end, and month dates on month end. You can use the notation "E" after the period size identifier to align a single period to the end of period date, e.g. "S1YE,S1YE,S1YE,3Y" will show 3 serial years each ending on year end, followed by one "overlapping" three year period.

Use Truncated Descriptions - This control allows you to specify that any security or transaction description in a report be "truncated" to exclude the part of the description contained in parentheses. This allows you to include additional information in transaction and security descriptions without that information appearing in reports, as long as it is contained in parentheses.

Account Code Filter (Level 3/higher) - On occasion you may need to exclude an account from a report merged by Client Id, Family, Account Group or Client Group for a particular report without having to remove the account from the particular group. This field allows you to specify that only accounts with particular values in the Account Code field be included from this report, thus achieving your objective. If the list of Account codes is preceded by a minus sign "-", then the list is considered to be an exclusion list. Since the "Acct Code" field in the Account Records is limited to only three characters, the "More Acct Codes" field can be used to specify additional account codes using the notation "[ABC,XYZ,LMN] to specify these codes. The filtering convention is that if any of these Account record codes are found in the report account filter then the account is allowed (or excluded if preceded by minus sign). The Acct Code filter can also be be altered or disabled by inserting '//' prior to the symbols you want to remove from filter mechanism.

Position/Performance Reports

AIMR/GIPS Annualization - AIMR-GIPS performance reporting standards specify that periods greater than one year have ROI performance reported as annualized figures and periods less than one year be reported as non-annualized figures. Checking this control implements this in performance reports.

Never Annualize ROI < 1 Year - This is a variation of the AIMR/GIPS annualization in that if the field is "Annualized ROI" periods less than one year will not be annualized. However, if the field is "Non-Annualized ROI", unlike the "AIMR Annualization", this option allows non-annualized ROI for periods greater than one year. This is recommended in lieu of "AIMR/GIPS Annualization" if you want to show non-annualized ROI's for periods longer than a year.

Blank Annualized ROI < 1 Year - This variation of the AIMR/GIPS annualization shows a blank result for periods less than a year if the field is for annualized ROI. This is provided for consistency with the prior Captool for Windows software.

Normalize Period ROI's - If securities within a performance report showing security level detail are held for less than the full period, their performance is reported only for the time they were held. Checking this control causes the performance figure for such partial period holdings to be normalized to the length of the full reporting period so as to permit comparison to other securities that may have been held for the full period. If this control is set active, then you should specify a minimum ROI days (see below) to suppress figures for very short periods.

Exclude Missing Price Values from ROI - Mid-period valuations which are marked with "Missing Prices" (pink color) are excluded from time-weighted ROIs. If using Time-weighted ROI's you should generally ensure that all valuations are completely priced and rely upon this option only as a "stop gap". Period beginning or ending valuations with missing prices are still included even with this option set.

Full Period Benchmark Index ROI's - In Security detail performance reports which display a benchmark index, this control specifies that the benchmark will be computed for the full reporting period, rather than just for the period that the security in the detail record was held, which is the default behavior. You should set this control to "On" if you are normalizing Period ROI's (see above).

Rotated Orientation - This control, applicable particularly to portfolio performance and security metrics reports specifies that field labels and data fields be printed vertically rather than horizontally as in most reports. One form of portfolio performance report, "Cumulative Performance" normally leaves this option unchecked.

ROI Days/Year - This control allows you to specify the number of days/year assumed when annualizing ROIs, selecting from 365, 366 or 365.25, with the latter being an average over four years.

Cash Reporting - This allows you to control the visibility of the cash report record. If you choose to hide the record, it does not exclude the cash record from applicable subtotals and the grand total, so you should be sure that cash record does not have insignificant value or activity in the reporting period.

Money Market Reporting - This control operates similarly to the Cash Reporting control, but is covers records involving money market funds defined by their symbol and/or designation as money market fund in the Security Id record.

After Fee ROI Reporting - This control allows you to specify that after-fee ROI be hidden at the detail level and only shown at the subtotal or grand total level.

Sort Group by Value (Level 3/higher) - This control allows sorting the primary or secondary groups in descending order based on the first field in the report. That field can be any type of field, but typically may be the "End Value" field to order groups based on that field.

Closed Positions - This control allows you to either hide or "consolidate" positions that were open at the beginning of the report period but were closed out during the period. One of the "consolidate" options is preferred because it ensures that the subtotal and grand total records are consistent with the visible detail record.

Model Portfolio Detail - This control allows you to specify what level of model portfolio detail is displayed in a holdings report that includes model portfolio data fields.

Minimum ROI Days - If a security is sold off soon after the beginning of the report period or bought just before the end of the period, the period normalized return can appear exaggerated if the price fluctuates significantly during the short period. Specifying minimum ROI days allows you to report these as NMF figures.

Risk Free Rate - This allows you to specify an interest rate to be used in report computations, e.g. Sharpe Ratio, requiring a risk free rate of return. If no valid rate is specified, then a rate of 3% is assumed.

Alpha Beta Index - This allows you to specify a market benchmark index to be used for Alpha/Beta computations in the report. If no index is specified, then the Primary benchmark index specified for each account in the account record will be used as the Alpha/Beta Index for that account.

Mgmt Fee TACs for ROI's - This option permits you to specify which fee TAC's (usually MFE, MFS or MFD) are to be considered "management fees" for purpose of computing before/after fee ROI's. If you end the list with a percent amount, e.g. "MFE,MFS,MFD,50%", then only that percentage of the amount in these transactions will be considered as relevant fees for computing before/after tax ROI.

Gen Temp Valuations for Twtd ROI's - When you report time-weighted ROI's the results can be influenced by the frequency of the portfolio valuations. AIMR/GIPS standards have been and will become increasingly tighter in this regard. To minimize the need for daily portfolio valuations which would increase the size of the data base, this option allows you to specify that valuations be performed "on the fly" during reporting, using various frequency and/or cash flow criteria.

Multi-Acct Twtd ROI Composite Weighting - When running reports which combine results from multiple accounts, this control allows you to specify whether to compute the grand totals directly from the cumulative cash flow of all accounts (most accurate and allowed by AIMR/GIPS) or as the weighted average of the results of the individual accounts (also as allowed by AIMR/GIPS). The latter choice may be desired for consistency with prior reported results.

Dividend/Interest Lookup method - When the report include yield percent, dividend rate or annual income fields, this control specifies whether the rate is to be determined from the security records only (first option) or if security records are lacking data (as measured by rate=0), whether the dividend/interest rate is to be imputed from the portfolio history (second option). In either case the method used to determine rates from the security record is controlled by the "Distributions" control in the security record.

Account Open/Close Dates for ROIs - This control pertains to how the start and end dates are to be determined for accounts when the performance is from inception and/or to the close date of the account. If the option "AcctROIStartDate_&_AcctCloseDate" is used, the ROI start date will be the date you specified in the account record "ROI Start Date" field, even if there are transactions and valuations prior to that date, and the closing date will be the date specified in the Account "Close Date" field even though there may be subsequent transactions and valuations after that date. if the option "First/Last_Trans/Val_Record" is used the earliest non-zero transaction record and last non-zero transaction or valuation record will be considered the inception and closing date of the portfolio for purposes of this report.

Use Account ROI Exclusions - This option activates the exclusion of cash flows for symbols specified as "No ROI" in an accounts Portfolio Local Security records. This does not exclude these symbols entirely from the reporting, in fact the report "Start Value", "End Value", "Additions", etc. will continue to reflect the activity of such securities. However the ROI will be essentially computed as zero for the individual security if detail is displayed and the cash flows for transactions in that security will be excluded from aggregate cash flows for the portfolio and other groupings containing excluded securities. Users should note that exclusion of securities in this fashion may not be AIMR/GIPS compliant. If you are excluding a security because it is "not being managed" by you you may wish to consider other alternatives to exclusion such as setting up a separate portfolio containing such unmanaged securities and excluding such portfolio from AIMR/GIPS composites.

Short Position ROI's - This option when selected causes the ROI on short positions to use the short opening value as the basis for the ROI, effectively limiting the maximum ROI to 100%. This does not generally affect the overall portfolio ROI, just holdings or groups of holdings that are short.

Use Accrued Fees in ROIs - This uses the data in the Accrued Fees field of an account's valuation records to compute after fee ROI's. This is particularly of use to prevent ROI distortion for accounts being charged a once yearly incentive fee whose accrued liability builds up through the year. For this to be active, the fee rate records must have the "Accrued Fees" option checked (the "Fee Class" field on the Account record should then appear yellow) and the Est. Accrued Fee field on the valuations records populated by highlighting the field and click the "compute" icon. This is a level 4 feature.

Use Security Note Sub-Allocations - This feature (level 3+) allows the user to use the security note records, for reporting purposes, to specify "sub-allocations" for a security category. To use this feature you must create a Security Note record for each security (go to Securities/Histories/Notes on Captools/net Desktop) with the "Note Type" set to "Type Allocations". Then in the "Note" field, specify the sub-allocations in the form "Categ1=xx%, Categ2=yy%, etc" with the percents adding to 100. When this is done the record for a single symbol in a position report (only that report type) will be split up into several records using the categories and percentages specified.

Report Currency - This field is used for multi-currency reporting to specify a second currency into which to report security and portfolio values. E.g. if a base currency for an account is in EUR and holding are held world-wide in a variety of currencies, US$ might be placed in this field and the "Aux Exchg Rate" and "Aux Value" fields specified in the report to report values in US$ as well as the base currency, Euros.

Hide Asset Symbol Detail - If you assign the common Asset Symbol to a security and its options so you can group them in your report, this option, when checked indicates that the detail lines are hidden and only the sub-totals are to be displayed in the report, i.e. it shows only the full outcome of the strategy without confusing the viewer with offsetting option results.

Can Hide Category Detail - The " Security Types/Categories" records contain a "Hide Categ Rpt Detail" field, supported at license level 4, which permits suppression of reporting of detail records for selected grouping categories. In order for that feature to function, the "Can Hide Category Detail" field must be checked.

Period User Labels - This control allows the user to specify "custom" period column header labels for the report. You can simply enter text, separated by commas to indicate the period label. However that text can contain placeholders for years, months, days, and quarters. Years can be "yyyy" for 4-digit years or "yy" for two digit years. Months can be expressed as "mm" or "mmm", where the latter results in the first three letters of the mon, e.g. "Nov" for November. Days must use "dd" and quarters "qq" where quarters are expressed as "Q1", "Q2", etc. Any combination of these placeholders may be used and other characters can be used as separators.

Transaction Reports

Show No Activity - Unless this option is selected a transaction type report will not be printed if there is no activity in the reporting period.

Show Trades Only - This option limits transactions reported to only those involving trades and excludes cash and money fund transactions.

Suppress Sales Lot Detail - Captools/net "expands" sell trades into multiple transactions, when necessary, in order to assign specific tax lots when the shares being sold resulted from multiple purchase transactions. Selecting this option causes the multiple sell transactions to be reported as a single transaction, without the multiple tax lot detail.

Quantity Filter, Amount Filter, Tax Filter - These controls permit you to exclude reported transactions based upon whether the values in these fields are equal to, less than or greater than zero.

TAC Extensions - This control allows you to include or exclude transactions based upon their transaction codes. The notation used is similar to "+[BUY,BYD]" for inclusions, and "-[DPF,WDF]" for exclusions. If inclusions are specified, only those transaction are reported. If exclusions are specified, then all transactions but those in the exclusion set will be reported, subject to the other reporting options.

Fee Reports

Pro / Enterprise level management fee/billing reports, including their special options are covered separately under the topic Management Fees/Billing in the Advanced Appendix.