|

Cost Reconciliation |

|

|

|

|

Cost Reconciliation |

|

|

Cost Reconciliation

Starting year end 2011 U.S. Investment custodians will be required to report cost basis information on Internal Revenue Service form 1099. This puts increased importance on ensuring that cost basis as tracked in portfolio management software such as Captools/net reconciles with the cost basis being attributed by the custodian to the IRS. As of Q1/2011 some custodians have started to provide to their investment advisors additional data files which contain cost basis information on closing trade transactions (Realized Gains) and cost basis information on open positions (Open Lots). Captools/net has accordingly added two additional tables accommodate investment advisor reconciliation of cost basis with their custodian.

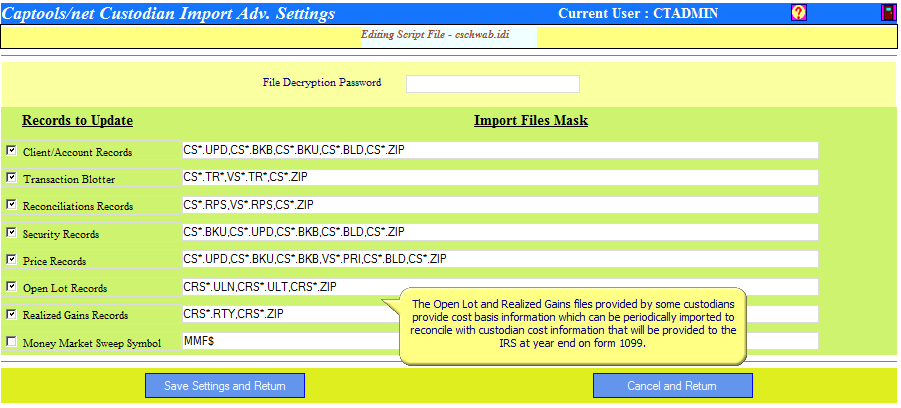

Please note that these tables will only be of use if your custodian is providing you with importable records containing cost bases information. As of early 2011, some, but not all custodians supported by Captools/net have indicated that they will provide such data. The Captools/net "Advanced Settings" on the import interface generally will indicate whether we are supporting import for one or both of these tables for your custodian. If the interface is supporting such imports you will see an Import File Mask for the "Open Lot Records" and "Realized Gains" records in the settings, example below:

If your custodian interface is not indicating an import of cost basis information, we suggest you contact them about the availability of such data, and if available, please contact us for a script update to support it.

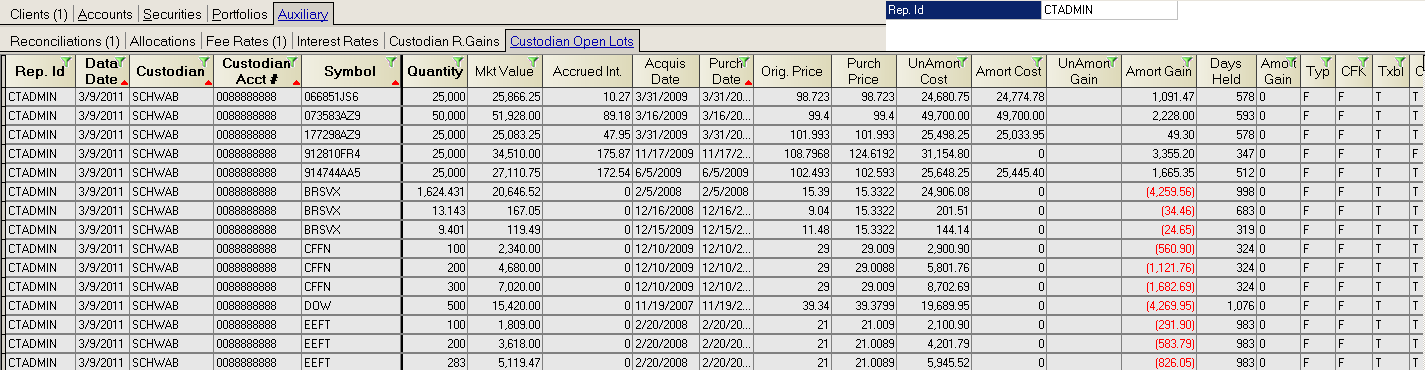

Custodian Open Lots

The custodian open lot records provided by your custodian will generally be "as of date" records of open lots in client accounts, with associated cost basis as computed by the custodian. These records will typically be replaced with each import with only the most recent "as of date" records stored. The comparable Captools/net open lot information will be filled in on the far right of these records (not shown in example below) during batch valuations to allow identification of any cost differences between the custodian and Captools/net. Selecting a record and clicking the "Portfolio" tab will take you to the applicable portfolio records for diagnosis and correction of any differences.

To populate the "Portfolio" side of this table, highlight a "Pf Account Number" and click on the "Compute" (calculator) icon, wait and then click on the "Refresh" icon. If the "Purchase Date" of a transaction precedes the date of the earliest transaction in a given portfolio, then the reconciliation process will insert Initialization RCV transactions containing the applicable cost information in the Aux Date and Aux Amount fields.

Populating Cost in RCV transactions - Often "Receive" transactions (with "RCV" TAC code) can enter a portfolio without the applicable purchase date and cost being assigned in the "Aux Date" and "Aux Amount" fields. You can "force" the applicable cost back to these transactions by highlighting the "Pf Cost" field for one or more records and then clicking on the "Compute" icon. This will split any initialization RCV transaction records into separate records corresponding to the individual lots indicated by the custodian.

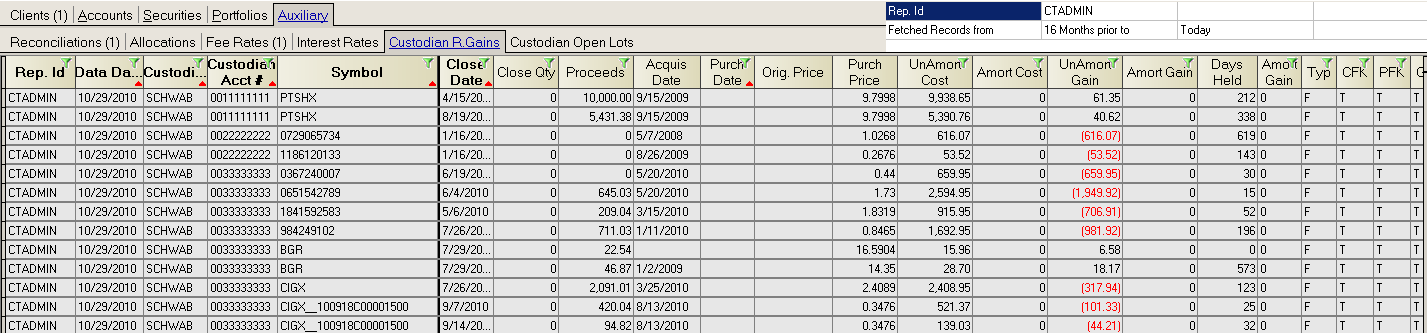

Custodian Realized Gains

The custodian realized gains records provided by your custodian will generally be a cumulative year-to-date record of all the closed transactions in client accounts that are reportable to the IRS on form 1099. Some custodians may also provide such information for tax-deferred accounts as well. Upon import into the Custodian Realized Gains Table the data will appear similar to:

Captools/net will store a running history of realized capital gains/loss records here, which can optionally be used to generate realized gains reports to ensure congruency with custodian data. Selecting a record and clicking the "Portfolio" tab will take you to the applicable portfolio records for diagnosis and correction of any differences. Selecting the "UnAmort" or "Amort Cost" fields and clicking on the "Compute" icon (or Data/Compute command) will push the custodian's cost to the "Aux. Amount" field of the applicable portfolio closing transaction.