|

Zero-Coupon Bonds |

|

|

|

|

Zero-Coupon Bonds |

|

|

Zero-Coupon Bonds

A Zero Coupon Bond does not pay the holder interest, but is instead issued at a price which is at a significant discount from the bond's redemption (face) value. For example, a ten-year, $10,000 face value bond might be sold at issue for $4,000.

If you are a U.S. taxpayer, you are not allowed to treat the gain from issue to redemption as capital gain income. Instead, you must report a portion of the gain each year as imputed interest on the bond. This is accomplished using the ACR (Accretion) transaction code. Accretion transactions do not affect the cash balance in the portfolio but are recognized in income reports and tax computations. Accretion transactions should be entered at the end of each year for tax purposes, but may be entered more frequently, if desired.

The amount in the ACR transaction can be computed using the Data/Compute Field command provided that the bond maturity date, maturity price and accretion method are specified in the bond's security list record. If this computation does not appear to work, check to see that these items have been properly specified. If the bond issuer provides interest accretion figures, these can be manually entered in lieu of the computed figures.

If the same issue of a ZCB bond is purchased into a portfolio on several different dates, then lot numbers must be assigned to the original purchase transactions and subsequent ACR transactions. Otherwise, if there is only a single holding of a given ZCB bond in a portfolio, then lot numbers may be left blank.

The sale or redemption of a ZCB bond should be accompanied by a final accretion transaction of the same date of the sale, but preceding the sale transaction. If sale proceeds do not equal the purchase price plus accreted interest earned to date, then the excess or shortfall will be treated as a capital gain or loss.

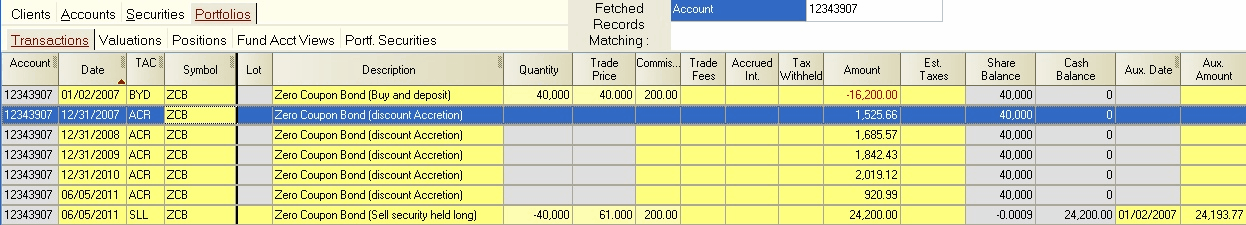

Transactions for a typical zero coupon bond would appear as follows:

Zero coupon bonds should be valued using market prices. If these are not readily available, the bond can be valued at its purchase price plus accreted interest earned to date. This value is contained in the Cost field on the Position record display, and can be copied and pasted into the Mkt. Price field on that screen.