|

Warrants |

|

|

|

|

Warrants |

|

|

Warrants

"Warrants" to purchase shares in a security at a later date may be issued at no cost to existing shareholders. These may be sold or later used to buy shares in the underlying security at the price specified in the warrant.

Warrants which are received (not bought) should be entered in Captool using the Receive Option (ROP) transaction code. The warrant's symbol should be entered in the Security Id records as a Call option with the warrant expiration date and strike prices specified in the Option section of the Security Id record. When a warrant is exercised, i.e., converted into its underlying security, an Exercise Option (XOP) transaction should be used in conjunction with a BUY transaction for the purchase of the underlying security.

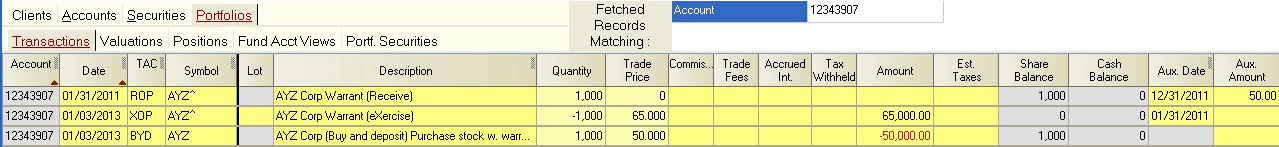

The following example shows how ROP and XOP transactions were used when warrants for 1000 shares of AYZ security were received and later exercised at an exercise price of $50 when the market price was $65:

If warrants are purchased, instead of being received, a normal BUY transaction should be used in lieu of the ROP transaction. If a warrant is sold instead of being exercised, a normal SLL transaction should be used.