|

Fund Accounts |

|

|

|

|

Fund Accounts |

|

|

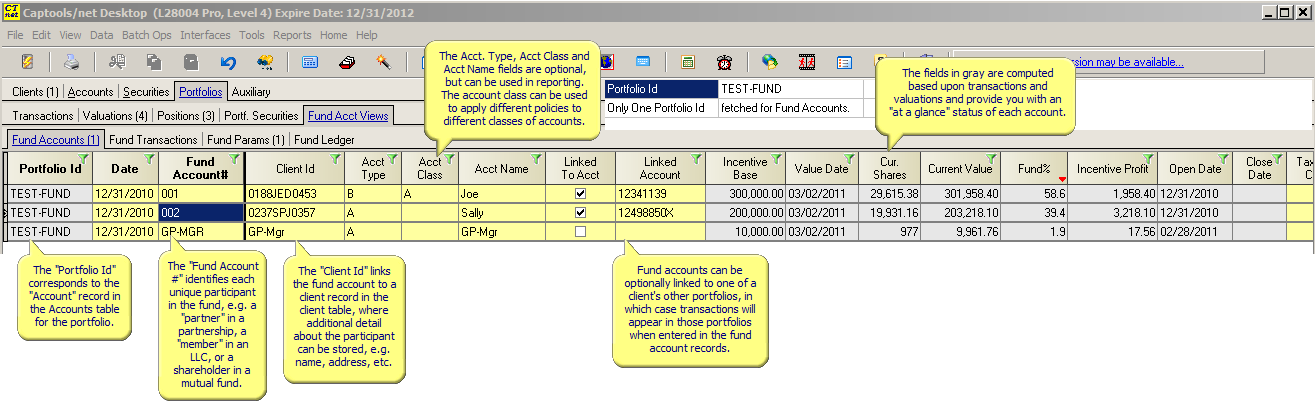

Fund Accounts

The Fund Accounts records contain a listing of all the participants in the fund, listed by a unique account number which may consist of numbers or letters or a combination of both. Other information fields are also provided in the record as indicated below.

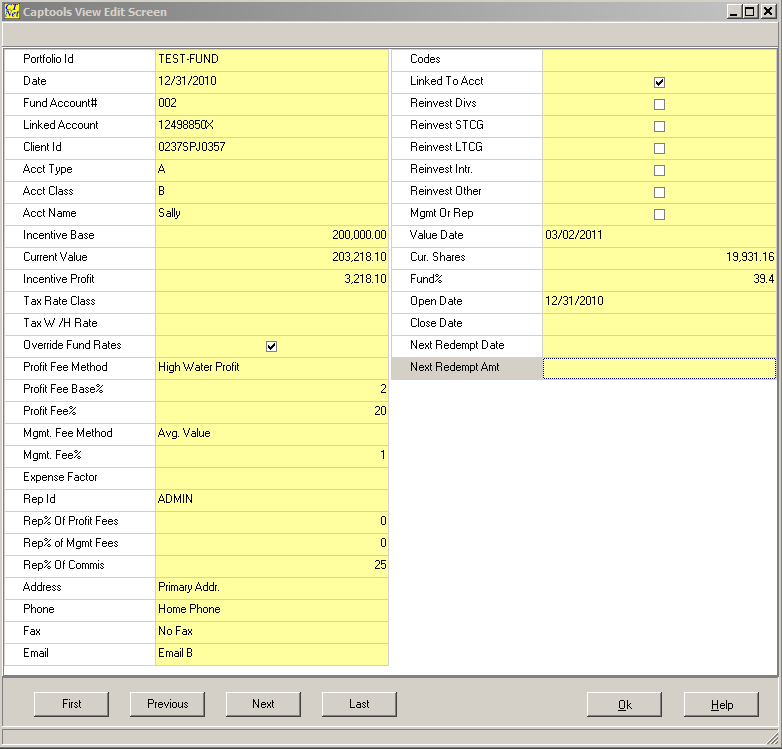

The records can be edited in the grid, or alternatively in "form" format by double-clicking on the record or by clicking on the "Data/Edit Record" command:

The Fund Account fields operate as follows:

Fund Id - The account number of the fund in the main Captools/net account list. To changes this you must edit it in the main account list.

Date - This is the "effective date" of the record. Multiple records can exist with the same Portfolio Id and Fund Account #. The operative record for a transaction or report will be the most recent prior record relative to the applicable transaction record.

Fund Account # - This contains the account identifier assigned to the fund participant. Please note that this account number must be unique within the particular fund.

Linked Account - This optional field contains the account number of one of the participant's other accounts into which you want copies of transactions placed. The "Linked To" field (see below) must be checked for this to be operative.

Client Id - This optional field contains a client identifier which appears in the Captools/net "Client" table. This makes additional client information contained in that table (e.g. email address) available for reporting purposes.

Account Type - This optional field allows you to categorize and group accounts for management or reporting purposes.

Account Class - This optional field allows you to link the account to a "Fund Parameters" record (see next topic) which contains additional specifications as to how the account is managed and billed.

Account Name - This optional field allows you to assign a name to the participants account.

Incentive Base - This computed field tracks the current "base" for purposes of computing the high water mark incentive fee. This field is not editable.

Current Value - This computed field displays the most recent computed value for the account. This field is not editable.

Incentive Profit - This computed field displays the current billable incentive profit for the account, i.e. the billable profit achieved since the last billing. This field is not editable.

Tax Rate Class - This optional field allows you to specify a tax rate class contained in the Captools/net "Tax Rates" table for purpose of computing "Estimated Taxes" on the participant's fund transactions. If this field is left blank, and you have assigned a "Client Id" to the account, then the Tax Class assigned in the client record will be used.

Tax W/H Rate - This optional field allows you to specify the rate at which tax will be withheld from income credited to the account (in the case this is required by the IRS for this participant).

Override Fund Rates - This optional field allows you to specify that the management fee and incentive fees for this account will be from the following fields rather than from the "Fund Parameter" records for this fund.

Incentive Fee Method - This specifies how incentive fees are computed with the options being "No Concession (none)", Period Profit, or High Water Profit.

Incentive Fee Base% - This specifies a hurdle rate to be used in computing the incentive fee. Any profit achieved under this rate will not be charged an incentive fee.

Incentive Fee% - This specifies the incentive fee rate expressed as a percent.

Mgmt Fee Method - This specifies the method for computing the management fee as follows:

None - No management fee.

Advanced Billing - The fee is based upon the period starting value and is for the upcoming period.

Advanced Adjusted - The fee is based upon the period starting value and is for the upcoming period, but is adjusted for additions or removals made by the participant in the prior period.

Beginning Value - The fee is based upon the beginning value of the account in the prior period and is billing for the prior period.

Average Value - The fee is based upon the average value of the account in the prior period and is billing for the prior period. Note that the average as computed will be dependent upon the frequency of valuations.

Ending Value - The fee is based upon the ending value of the account in the prior period and is billing for the prior period.

Mgmt Fee% - This specifies the management fee rate expressed as a percent.

Expense Factor - This field provides a way to charge an account for transactional activity for the period. E.g. if the expense factor is 0.0001, then one basis point would be charged in an "EXP" transaction generated using the Transaction Generation tool on every transaction in that account for the specified period.

Rep Id - This field provides a way to attribute proceeds from an account to a representative assigned to the account.

Rep % of ... - The fields (Rep% of Profit, Rep% of Management Fee and Rep% of Commission are associated with the "Rep Id" field.

Address, Phone, Fax, & Email - These specify which address, phone and email fields to be used from an associated client record.

Codes - This field is reserved for special use to be determined later.

Linked to Account - See "Linked Account" above.

Reinvest ... - These fields specify how various earnings distributions are to be handled for the account.

Mgmt or Rep - This allows the account to be associated with the fund management.

Value Date - This is a computed field, containing the date of the most recent valuations.

Curr. Shares - This is a computed field, containing the most recent computation of shares associated with the account.

Fund % - This is a computed field, containing the most recent computation of the percentage holding of the fund that the account comprises.

Open / Close Dates - These permit you to identify when that account was opened and closed, for reporting purposes.

Next Redempt. Date / Amount - These fields allow you to specify when the account is eligible for redemption and the applicable amount.