|

Client List |

|

|

|

|

Client List |

|

|

Client List

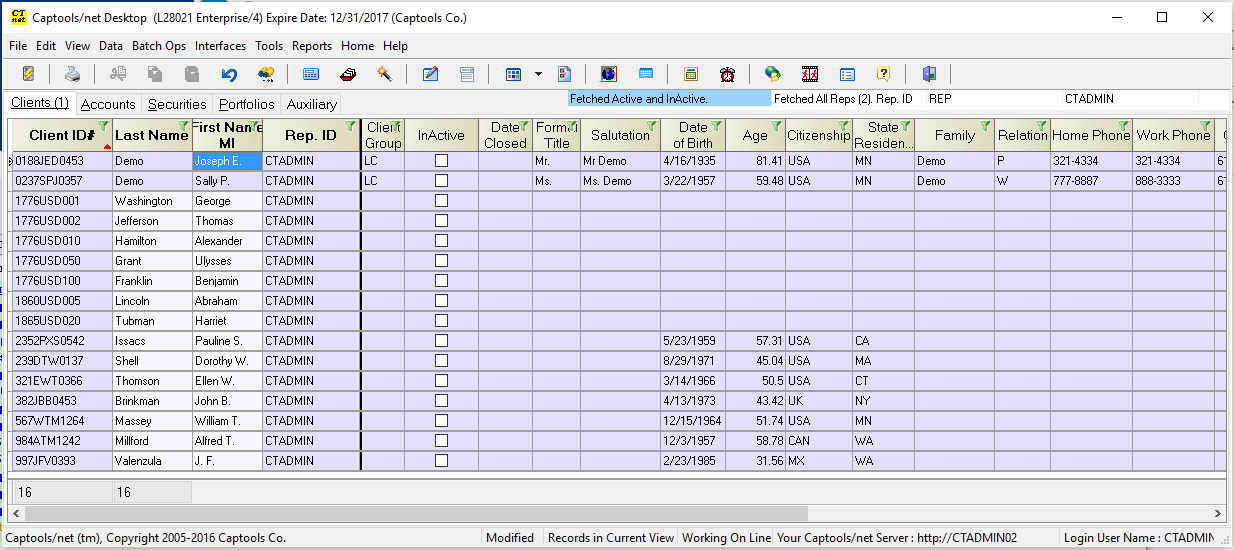

The Client List table displays all client records permissioned to you based upon your log-in Id and log-on options.

The top part of the client list display shows the client records. Most of the data fields are self-evident and do not need further description. However, you should note the following fields have special requirements:

Client ID - This field must contain a unique value for each record. This value must not only be unique relative to all the other records in your client list, but must be unique relative to all client records in the data base on the server. If you attempt to enter a new record with a Client-Id which already exists in the database, it will not be allowed to post to the database and you will need to change the value in this field. If this occurs, you should review your client records for an already existing instance of the Client ID, and if that is not found, consult your system data administrator to find out which other system user has a client with that tax Id. You would then need to resolve with that user who can use the Client ID.

If you have a situation where a client is giving business to more than one rep on the system, then the second and subsequent reps would need to use a slightly different Client ID for the client, e.g. by appending a "-1", or "-2", etc. to the Client ID. This approach may also be used if you have a client who wants strict segregation of accounts, e.g. one set of accounts are to be reported to one location and another set of accounts to a second location.

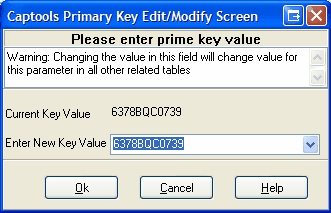

Because the Client ID links the client record with the account record, you can only change this field through a special control that appears when you attempt to edit this field:

Alternatives to using Tax ID as Client ID - One solution to generating a unique Client ID is to simply use the client's tax identifier or social security number. This will work in Captools/net. However, due to heightened public concern about maintaining the privacy of such numbers, you find it prudent to generate another identifier. Such an identifier must be easily constructed from client information that will not change over their lifetime. Thus you should not use their postal code, telephone number, or driver's license as part of the identifier. However, the initials of their name (maiden last initial for married woman), date of birth, date of birth of a parent and/or part of their Tax ID could be used to construct a client identifier that would likely be sufficiently unique for purposes of the data base. E.g. if a client is Mary T. Smith (former "Jones"), date of birth 06/29/63 and a Tax ID of 321-56-9782, the Client ID might be "9782MTJ62963". If you do not expect to have more than a few hundred or thousand clients, then a shorter form of the client number may be reasonable, e.g. "9782MTJ63".

Importing Third Party Data with Tax ID - If you decide to avoid using the Tax Identifier as a Client ID, you still may have to deal with third party data providers such as custodians or clearing firms who use the Tax ID as a unique client identifier in their data. In such a case, the Tax Id will be typically imported into Captools/net Client ID field upon the first time import, at which time you can change the Client Id to your schema.

Reporting to Government - One potential problem if you have decided to use your own client identifier rather than the government-assigned tax identifier, is that you may be required to report client information to the government using the government-assigned tax identifier. Typically this will only be required if you are operating as a custodian for your client which will not usually be the case. However, if you do have this requirement, you can use the tax identifier as the client identifier, or alternatively if you are operating the Enterprise level with B/D or Mutual Fund option, contact Captools Company for details on options on how you can separately maintain the tax identifier in a secure fashion.

Rep Id - This field identifies the system user who "owns" the client. It is used to determine whether a client record can be loaded when you log-on to the system. This field normally will be pre-filled when you create a new record. If you attempt to change the Rep Id field in a record you will be only given the opportunity to change it to a Rep Id that is permissioned to you. If your System Administrator has set you up to have access rights over a number of Rep Id's (i.e. you are their supervisor), you can change the Rep Id to one of those other Rep Ids. If you want to change the Rep Id to one over which you do not have access rights, then you will need to get a user who has rights to both your Rep Id and the new Rep Id to make the change.

Inactive / Date Closed - These fields allow you to indicate that a client and their accounts are no longer active as of the "Date Closed" date. This allows Captools/net to skip these accounts when it performs various processes, e.g. valuations, reports, etc., and thus operate more efficiently.

The bottom of the client records table display shows "client relations" records, available at the Pro and higher levels of the software. These records allow you to maintain a list of any individuals who are key relations with the client whose record is in focus. These records are "view-only" in the grid view, but can be edited when the client and account records are put in the "Edit" mode as covered in the topic Client Relations Editing.