|

Treasuries |

|

|

|

|

Treasuries |

|

|

Treasuries

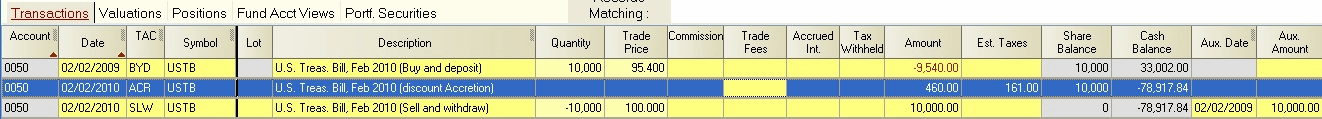

The treatment of investments in United States Treasury securities varies depending upon the type of security. Treasury notes and Treasury bonds are treated like bonds. For example, assume you purchased a $10,000, 5.5% three year note at one of the regular Treasury auctions or through the Treasury Direct program. Assume that it is purchased at a slight discount price of 99.75 and you hold the note until maturity. The transactions would appear as follows:

The ACR transactions are used to "accrete" the original issue discount so that there is no capital gain once the bond matures. If the bond had been purchased at a premium, an AMT amortization transaction would be used in lieu of the accretion transactions. U.S. tax law requires taxes be paid on accreted discounts, and conversely, permits a reduction in taxes due to amortized premiums. See Bond Discounts & Premiums for more details on these types of transactions.

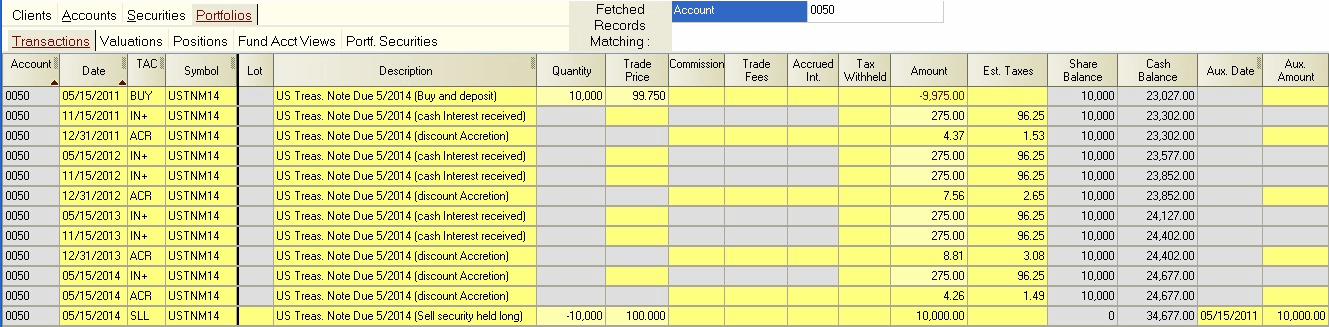

Accrued Interest - If a Treasury note or bond is purchased or sold in the secondary market, the purchase and/or sale should include accrued interest paid on the purchase, or received from the sale of the bond. Consider a $100,000, thirty year, Nov. 2019 Treasury bond which is purchased at a premium and then later sold on the market prior to maturity. Both the purchase and sale transactions contain accrued interest as shown in this example:

Note that this example also shows amortization transactions.

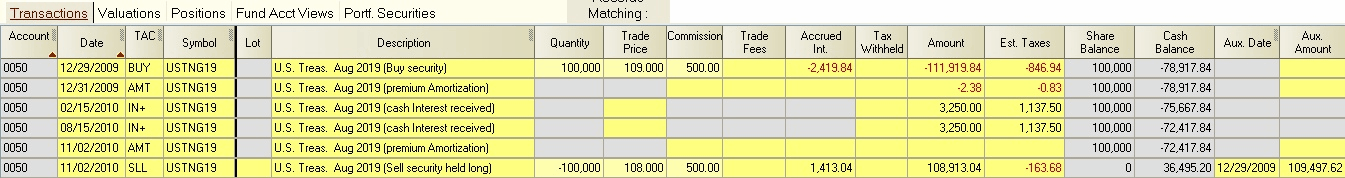

Accreted Interest - Treasury Bills are Treasury debt with 52 weeks or less of maturity at issue. These are normally sold at a discount and redeemed at maturity for face value. The ACR (accretion) transaction is used to accrete the discount in a fashion similar to a zero coupon bond. This is illustrated in the following example involving a 52 week bill: