|

Portfolio Securities |

|

|

|

|

Portfolio Securities |

|

|

Portfolio Securities

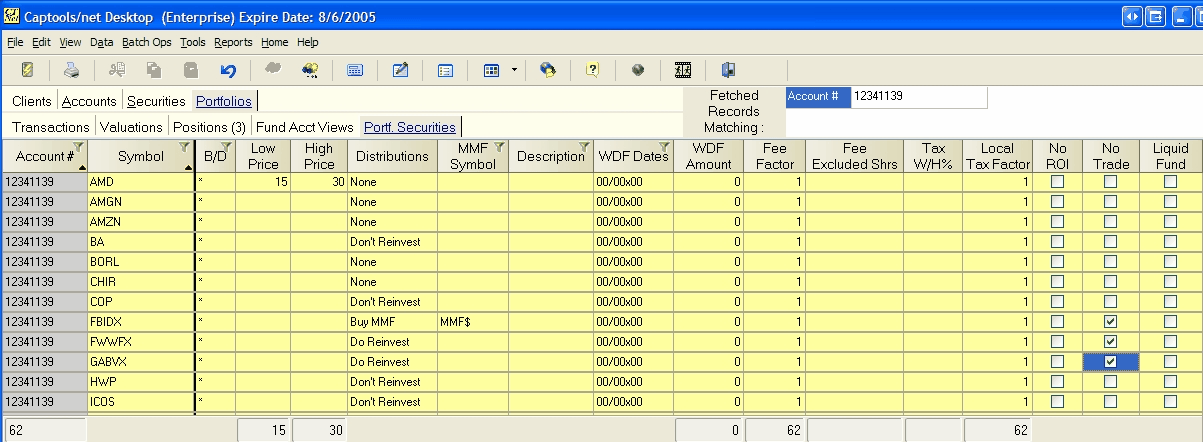

Portfolio Securities records permit you to optionally specify some security parameters to apply uniquely to a given account portfolio. The typical standard Portfolio Securities record grid view appears as follows:

New Records - Since Portfolio Security records generally override preferences specified elsewhere, new records must be manually entered.

Portfolio Securities Record Fields

The Portfolio Security Record fields function as follows:

Account - Account number of applicable portfolio.

Symbol - Security identifier of applicable security.

B/D - Custodian identifier. This allows you to indicate that the record applies only to a security held at a specific custodian. A blank value or "*" indicates the record applies regardless of where the security is held. The custodian identifier is defined in the Sub-Account records.

Low/High Price - Low and High price limits desired for this portfolio. These can be include in Holdings and similar reports.

Distributions - Indicates how distributions are to be handled if you are using the Distributions Generation data tool. This value overrides the general specification used when you run this tool.

MMF Symbol - If the distribution is to be invested in a money market fund (i.e. "Buy MMF"), this indicates the ticker symbol to be used for that fund.

Description - Security description, retrieved from Security Id records.

WDF Dates - Specifies dates to be used for periodic withdrawal of funds from the account. Use same notation as dividend and interest payment dates in Security Id records.

WDF Amount - Specifies the dollar amount to be withdrawn in periodic withdrawals.

Fee Factor - This factor is applied during computation of management fees against the account. It reduces the management fee for the particular security by the specified factor if the factor is less then 1.0 and increases the fee if the factor is greater than 1.0. If blank then the factors in the Security Id record apply.

Fee Excluded Shares - This permits exclusion of a fixed number of shares of the security from the management fee computation.

Tax W/H% - This specifies the tax withholding percentage for the applicable security for this account. If non-blank, this overrides the Tax W/H factor specified in the Security Id records.

Local Tax Factor - This specifies the local tax factor for the applicable security for this account. If non-blank, this overrides the local tax factor specified in the Security Id records.

No ROI - This specifies to exclude this security from performance computations for this portfolio.

No Trade - This specifies that the security is to be excluded from trades computed by the trade generation tools.

Liquid Fund - This specifies that this security is to be treated as a liquid fund in rebalancing the portfolio even if it is not otherwise indicated as a money market fund.