|

Mergers |

|

|

|

|

Mergers |

|

|

Mergers

Many corporate mergers are implemented through the exchange of securities issued by the buying company for the securities of the purchased company. Occasionally, a company will also exchange one class of security for another security or will distribute new securities in a divested subsidiary. These transactions may or may not be tax-free, depending on the circumstances.

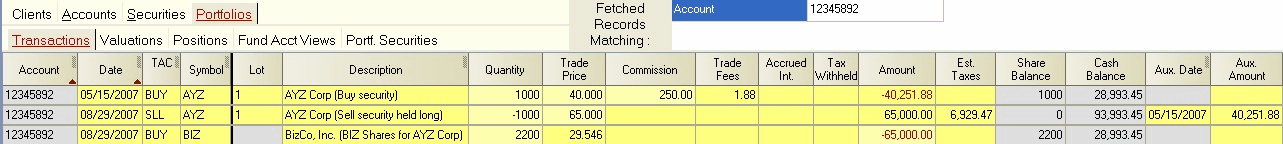

Taxable Exchange - If an exchange is taxable (generally the case), it is implemented in the portfolio by entering a sell transaction to close out the old security position. This is followed by a buy transaction on the same date to open the new security position. Typically, the Amount field of both the sell and buy transaction will be identical, computed at the merger transaction's stated price:

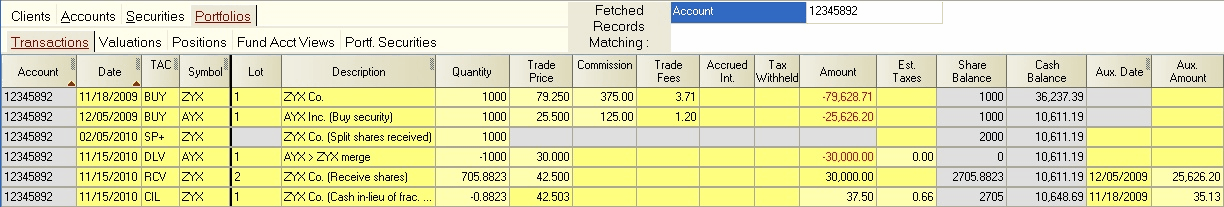

Tax-Free Exchange - If an exchange is tax-free (infrequent, usually involves recapitalization), the portfolio entries are a little more complex. The old position is closed out using a DLV transaction with a zero manual tax entry on the date of the exchange. The new security position is opened by entering a RCV transaction and using the Aux. Date and Aux. Amount fields to specify the original acquisition date and cost basis. This approach maintains a correct cash valuation and also ensures the correct cost basis and holding period on capital gains reports:

Merger of Portfolio Securities - Occasionally a merger involves securities which are already both held in a portfolio, and you receive shares for which you have previously entered a split transaction in the portfolio.

Example: Suppose you buy 1000 shares each of ZYX Co. and AYX Inc. Later, ZYX Co. splits 2 for 1. Then AYX Inc. merges into ZYX Co. and you receive additional shares of ZYX in exchange for your AYX shares. You accomplish the exchange using DLV and RCV transactions as follows:

In this example, the DLV transaction has a manually entered zero estimated tax value to indicate the non-taxable nature of the merger. A new tax lot number is required for the RCV transaction so that its cost basis is not adjusted as a result of the earlier split in ZYX. A CIL (cash in lieu) transaction is used to deal with the partial shares generated as a result of the merger. If the merger were declared taxable for those delivering shares, you would allow the estimated taxes in the DLV to be computed, and you would blank the Aux Date and Aux Amount in the RCV transaction to indicated that the RCV cost basis was identical to the amount and cost date the same as the RCV date.

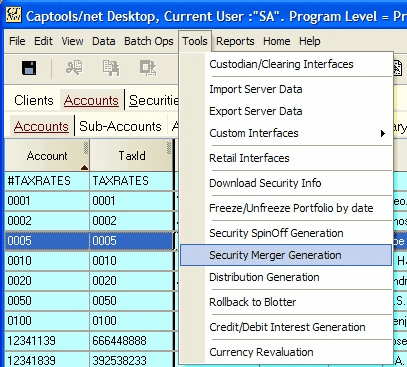

Merger Utility - If you need to enter merge transactions for many accounts, this can most easily be done by using the Security Merger Generation utility, found on the Tools submenu:

The merger utility is covered in more detail in the topic Data Tools.