|

Intra-Day Values |

|

|

|

|

Intra-Day Values |

|

|

Intra-Day Values

Subject to the availability of mid-day quotes from the internet, Captools/net can create an hourly updated current day valuation using such quotes. This gives users a view of how the current market conditions are affecting their holdings values and provide the current day's approximate "gain" or "loss" measure.

To activate and view the Intra-day Values the user must have activated the download of quotes from the internet such as from the Yahoo Finance site (see Download Scripts). Additionally you must check the "View/Show Intra-Day Values" menu item:

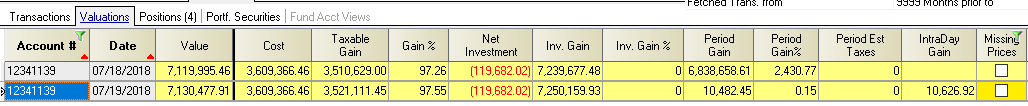

Once activated, results are generated during the current day and shown several places on the Captools/net Desktop grid view. First is in Account table where the Date/Time is shown with the account value at that time and account gain/(loss) for the date at that time (7/19/2018 in these examples). The time shown is the time the quote was downloaded, adjusted from the user's time zone to the market time zone. Typically this time will be delayed 15-20 minutes from when the quote was reported due to market rules regarding publishing quotes.

In the valuation records, the results are shown an "Intra-day Gain" column for the current date (7/19/2018 in example).

The "IntraDay Gain' field is recomputed based on final closing values when the final valuation is computed after the day is closed, and is retained for reference.

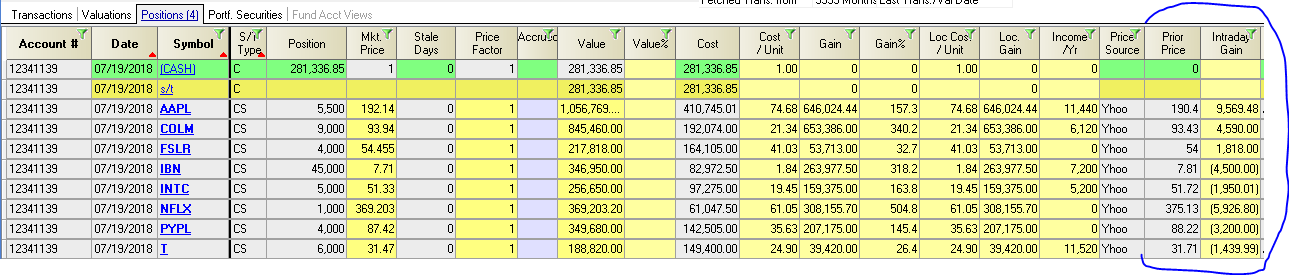

In the position records the results are shown via a "Prior Price" field which displays the prior day's market closing price, and a "Intra-day Gain" field (right side below) which shows the gain as the differential between the prior price and the current mid-day price times the number of shares held.

The number of shares are a clone of the number of shares shown in the most recent prior position records and thus do not reflect any transactions occurring between that date and he current date. Accordingly, for most meaningful results for intra-day valuations, one should value daily.

Captools/net triggers a price fetch for intra-day valuations whenever the user moves between to the account table from another table and at least one hour has elapsed since the last price fetch. This time limitation is to prevent too much of a load being generated on the data sources servers as a result of Captools/net users.

No Intra-day Gain/Loss Client Reporting: Intra-Day Values and Gains are not made available in Captools/net for client reporting for a couple reasons. First, the figures do not take into account intra-day transactions, i.e. transactions like buy's and sells, deposits and withdrawals, corporate actions like splits and income received. It is based only on the price gain or loss for the day for each holding. In the case of the current day, the share quantity used is the beginning of day quantities and once the pricing for the day is final, it is based upon the end of day share quantities. If shares are sold or bought during the day the gain or loss will not be accurate to the extent that the trades price is different from the beginning of day and end of day closing prices. Second, the intra-day gain/loss is computed using price ratios which can be thrown off on the rare occasions there are corporate actions like spin-offs or splits, so these figures should be viewed with caution. Nonetheless, the intra-day gain/loss figure provides is useful in giving the Captools/net user a quick picture of what went on in the market with their securities.