|

Fund Transactions |

|

|

|

|

Fund Transactions |

|

|

Fund Transactions

A fund accounting portfolio contains two transaction tables. The first table is the standard portfolio transaction ledger that all Captools/net portfolios contain. This is where you record the deposits and withdrawals and security transactions such as buys, sells, and dividends, etc. which represent the activity in the portfolio.

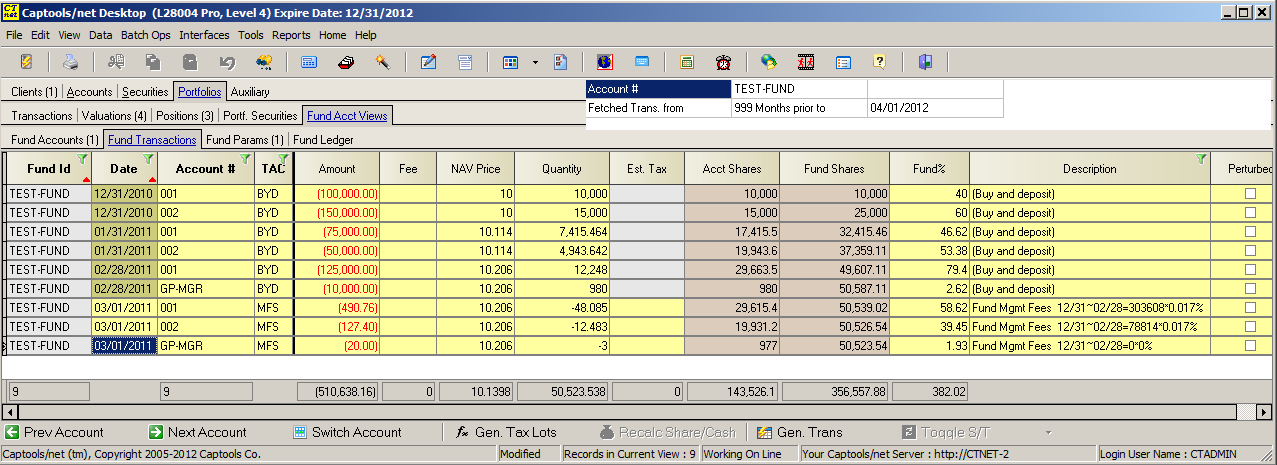

The second transaction table contains the "Fund Transactions". These records contain account identifiers so you can record the transactions of fund participants. These are typically transactions moving money into or out of the fund, or transactions recording income distributions to fund participants. The following is an example of fund transactions when a fund has just begun with deposits by two initial participants, plus a general partner/manager:

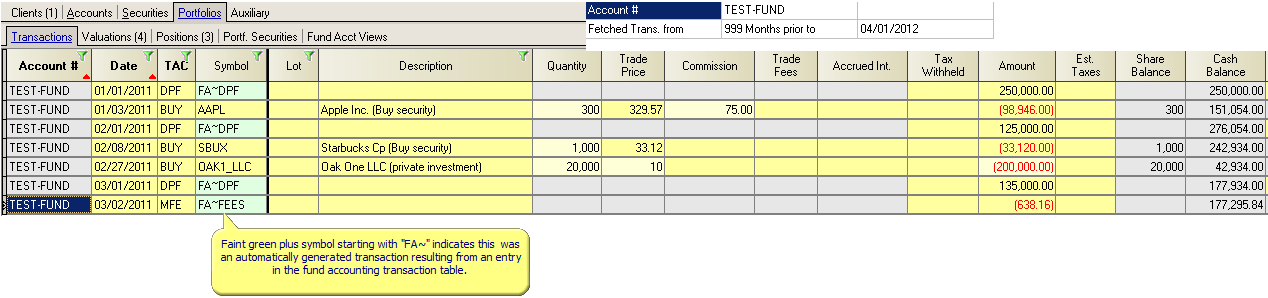

When any of the fund transactions add to or reduce monies available to the fund portfolio, there will be corresponding automatic entries in the portfolio transaction table:

Note that the opening day purchases by the initial participants are registered as a single next day's deposit of funds in the standard portfolio transaction ledger. The faint green shading in the symbol field along with a symbol containing "FA~" indicate that these were automatically generated from elsewhere in the program, and should not be manually changed.

It is usually a good idea to keep both the standard and fund accounting transaction ledgers open at the same time when data is being entered in the fund accounting ledger. This allows you to verify that the data is properly flowing through to the portfolio transactions from the fund accounting transaction ledger.

Fund Accounting Data Fields

The fund accounting transaction record data fields operate as follows:

Date - The execution date of the transaction. Important!: Except for the fund opening transactions, Captool will only permit entry of a transaction date which is equal to the last fund portfolio valuation. This is to ensure that an NAV value is available to compute transaction shares.

Account # - The account number of the fund participant to whom the transaction is attributed. This account number must match an account number or sub-account number in the default account list. If it does not, you will get an error message upon entering the account number.

TAC - The transaction code. The allowable transaction codes are a subset of the transaction codes used in the standard portfolio transaction ledger. The usage of these are defined in the next section.

Amount - Money amount of the transaction

Fee - Any transaction fee associated with the transaction.

Commission - Any commission associated with the transaction.

NAV/Share - Net Asset Value per share, or effectively the "price" at which the transaction took place. This will always be automatically computed by Captool by dividing the total value of the fund portfolio as of the transaction date by the total number of shares outstanding up to, but not including the transaction date. The exception to this is when the transactions are the initial transactions, in which case an NAV/Share of "10" will be assigned. If you want to use another initial NAV, enter it in the first transaction. We recommend, however, that the initial NAV be less than 100 so as to avoid share rounding issues that can occur at large (e.g. > 1000) NAV values.

Quantity - Number of shares associated with the transaction. These will normally also be computed by Captool by dividing the net amount (amount less commission and fee) by the NAV per share.

Months Held - This field is used for capital gains distributions only, to indicated the holding period, in months, for which the distribution qualifies.

Account Shares - Cumulative fund shares outstanding for the particular account specified in the transaction. This is an informational field only.

Fund Shares - Cumulative fund share outstanding for all accounts. This is an informational field only.

Description - Space for a brief note regarding the transaction.

Fund Account Transaction Record Freezing

Fund accounting records are automatically "frozen" whenever a portfolio valuation record of a later date is created. Frozen fund accounting transaction records appear with a green shaded background in all data fields except the description field, as shown in the first example above for the "Fund Opening Contributions" fund transactions.

Frozen records cannot be modified. Freezing is necessary because any change which can affect the number of outstanding shares would affect the NAV per share of all subsequent records, and consequently their computed share quantities.Since a fund portfolio valuation record must exist prior to entering a fund accounting record, this effectively means that all fund accounting transactions prior to the most recent transaction date will always be locked.

Unfreezing Records - To unfreeze records so that they may be edited, select the records you want to "unfreeze" and then execute the Data/Unfreeze Records command. Editing the fund accounting transactions will "perturb" subsequent portfolio valuations, meaning that each such valuation will have to be recomputed before you can edit the fund accounting transactions associated with that valuation date. This process may result in changes in NAV values and share quantities in records following the edited records.