|

Fund Transaction Generation |

|

|

|

|

Fund Transaction Generation |

|

|

Fund Transaction Generation

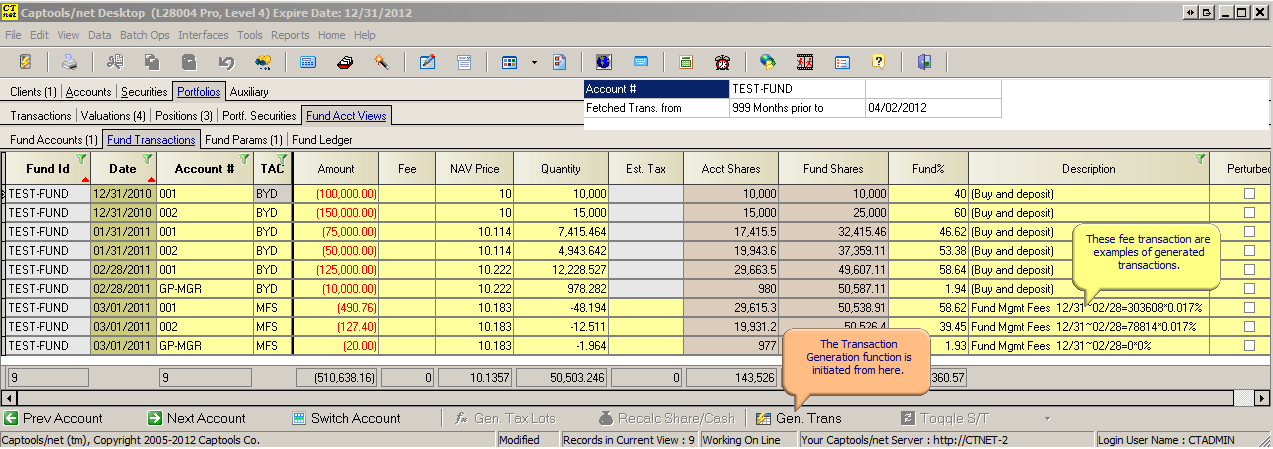

Other than additions and removals from a fund, most transactions within the fund can be generated using Captools/net's fund accounting, triggered by clicking on the icon at the bottom of the transaction table:

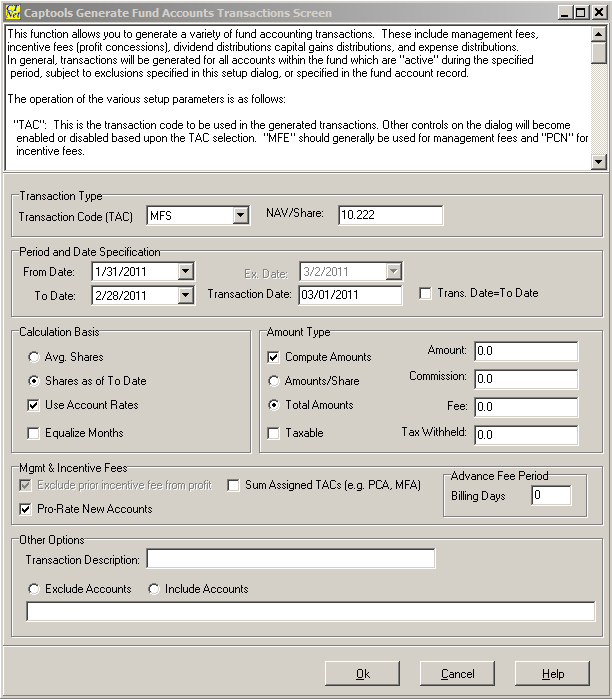

The resulting setup dialog appears as follows:

This dialog is a very powerful tool for generating transactions. Its options are context sensitive in that certain options are greyed out depending upon whether other options are activated. These operate as follows:

Transaction Code (TAC) - This must be specified. See the topic Fund Transaction Codes for a listing of codes.

NAV/Share - This will be pre-filled based upon the specified "To Date" (lower on the form) and will be used for reinvestment and liquidation computations. You should verify that the NAV is the one you want before you run the distribution.

Period From and To Dates - These specify the applicable date range to be considered for computing the transaction.

Transaction Date - This is the date to be assigned to the transaction that will be generated. This will typically be one day after the "To Date" specified, unless the "Trans Date=ToDate" is checked (not recommended).

This date must be after the last "frozen" transaction. If you specify a date which is frozen, Captools will warn you and give you the option to let it specify a valid date.

Calculation Basis

Avg Shares / Shares as of - These are applicable for most types of distributions. If "Avg Shares" is selected the distribution is computed based upon the time-weighted average number of shares in each account for the specified time period. If "Shares as of" is selected, the distribution is computed based upon the number of shares as of the specified "Ex-date" (the ex-date control becomes activated if "as of" selected).

Use Account Rates / Equalize Months - These options, greyed out in the prior example, are applicable only to management fee computations (MFS & MFD TAC codes), discussed in the next section.

Amount Types

Compute Amounts - This option specifies to have Captool compute the amount to be distributed based upon the TAC code. Thus, if you specify a TAC code of "CGR" (Capital Gains Reinvested) and a time period of the prior quarter, Captool will compute the realized long terms capital gains applicable to that time period, and will spread it across the relevant accounts.

Amounts/Share and Total Amounts - This option specifies whether the amount you enter into the "Amount" field (and commision, fee and tax withheld fields) is the total amount you want distributed, or is an "Amount per share" figure. In the prior example, the Amount field contains the total amount to be spread across all accounts.

Mgmt & Incentive Fees

This section only applies if the transaction code specified is a fee related transaction code.

Exclude prior incentive fee from profit - This is enabled only if the TAC code is an incentive fee code (PCA, PCN, PCS). It specifies that the relevant profit be grossed up by the amount of any incentive fees in the period.

Sum Assigned TAC's - If prior fees have been accrued, e.g. PCA or MFA type fees, and the fee to be generated will be taken in cash, this specifies to sum those prior transaction amounts to arrive at the relevant fee.

Pro-rate New Accounts - This specifies that accounts in existence for only part of the fee period should have the fees pro-rated.

Advance Fee Period - If a management fee is an "Advance Fee" type, this specifies the length of the period in days.

Other Options

Transaction Description - This allows you to specify the description to be used for the transaction. It is generally better to use the Captools/net default description for generated transactions.

Exclude / Include Accounts - This allows you to include/exclude accounts from the transaction generation process. Multiple accounts should be separated by commas. It is generally preferred that generated transactions include all accounts because any shares generated will affect the NAV/share and thus affect non-included accounts.

Once you click the "Ok" button you should see a record generated for every account containing a non-zero share balance.

Fee Generation - Many managers may debit administrative fees directly from the fund portfolio, without charging the participants directly. This results in a reduction to the NAV/share of the fund thereby imposing the fee indirectly, but still to all participants in proportion to their share holdings in the fund. However, you can debit each account directly. In this case, you should use the "FES" or "FED" transaction code, depending upon whether the fee is paid by liquidating shares (FES) or by an account deposit (FED).