|

Employee Stock Options |

|

|

|

|

Employee Stock Options |

|

|

Employee Stock Options

Employee stock options are not "investments" in the traditional sense in that they do not have an easily definable cost. However, they clearly have a value, although that value may not be easy to define.

The most conservative approach to handling employee stock options is to not enter them into a portfolio until the options are exercised and converted to stock. A normal BYD transaction would then be used to reflect the purchase of the underlying stock upon exercise of the options. If this incurs additional taxes under the Alternative Minimum Tax provisions of the U.S. tax laws and/or is subject to a special holding period for long term capital gains, you should make a manual entry in the Estimated Tax field of the purchase transaction, or enter a separate Estimated Tax (ETX) transaction, to properly reflect the tax impact of the exercise.

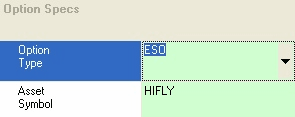

However, if you do want to include unexercised employee stock options in a portfolio, these can be entered by using the ROP (Receive Option) transaction code to record receipt of the option. The symbol used in the ROP transaction should be the same as that of the underlying stock, but with a "^" appended to indicate that the security is an option. You should also indicate the option type and underlying asset symbol in the Security Id record for the option:

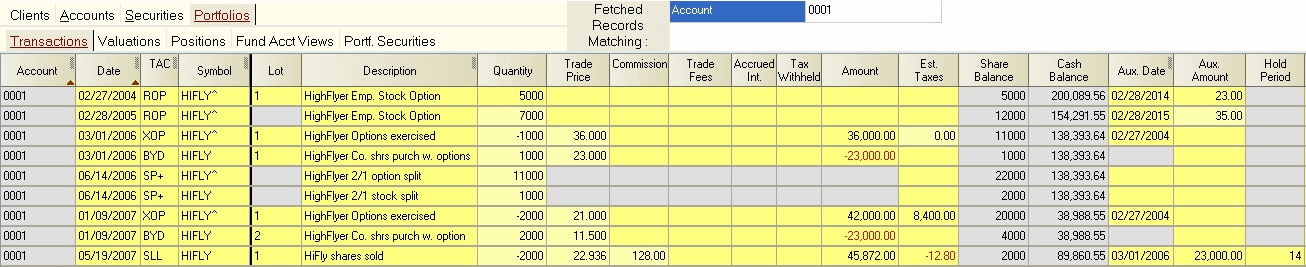

The Aux. Date field must also contain the option expiration date and the Aux. Amount field must contain the option exercise price. Multiple ROP transactions should be used if options with differing expiration dates and/or exercise prices are granted at the same time.

The XOP (Exercise Option) transaction code is used to record the exercise of the option. The Aux. Date field is used to match the exercise with the original grant transaction. If several prior grants have the same expiration date, then tax lot numbers should be used to ensure proper matching. Tax lot numbers can also be used to break option grants into vesting groups. The XOP transaction must be accompanied by a BYD or BUY transaction immediately following to indicate the purchase of the underlying stock at the option price.

The following example shows a series of transactions involving the receipt of option grants on two occasions. Some of these shares are later exercised. A stock split is also included. Note that separate split transactions must be entered for the options and for the underlying stock:

Captools position records will segregate the options from the underlying stock and will segregate multiple grants by expiration date. Options are valued at the current market price of the stock, less the grant price, but at no less than zero.

Option return on investment performance is computed based upon the market value of the underlying security at the time of the option grant. ROI performance of holdings in the underlying security is based upon the market value at the time shares are purchased. This is indicated in the above example in the XOP transaction preceding each BUY or BYD transaction used to acquire shares using options.