|

Dividends |

|

|

|

|

Dividends |

|

|

Dividends

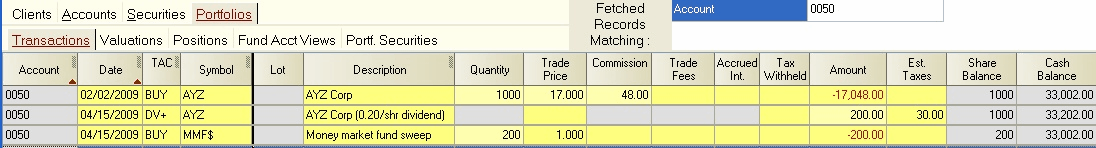

Cash Dividends - Cash dividends received on shares of common or preferred stock, or on mutual fund shares should be entered using a DV+ transaction code, provided the cash is left in the portfolio. The amount of the dividend will be automatically credited to Cash. If this money is later swept into a money market fund or used to purchase another security, a subsequent BUY transaction may be entered:

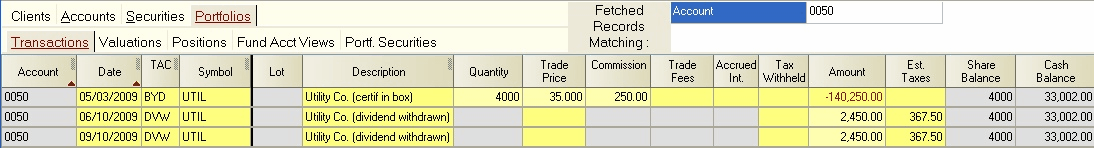

Dividends Withdrawn - Cash dividends which do not remain in the portfolio should be entered using a DVW transaction code. For example, you receive a dividend check for shares held in your safe deposit box. You then deposit the check in your checking or savings account which is not part of the portfolio which contained the shares paying the dividend:

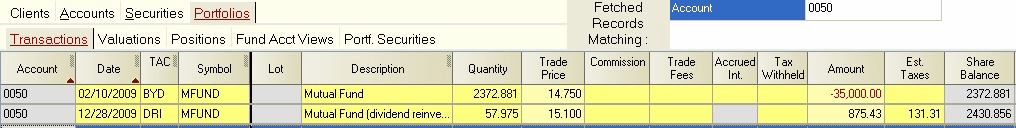

Reinvested Dividends - Mutual fund dividends or stock dividends which are reinvested in shares of the same security should be entered using a DRI transaction code:

If you know the exact number of shares and the amount of the dividend, you should enter these in the transaction record Quantity and Amount fields rather than entering the reinvestment price. This will ensure that your Captools/net records will exactly match those of the mutual fund company and will not be subject to differences in rounding methodologies between Captools/net and the mutual fund company.

Reinvestment Cost Basis - Reinvested dividends and capital gains distributions add to the taxable cost basis of your holdings. This is because you must pay taxes on the dividends and distributions when they are received. Adding the distribution amount to the cost basis prevents you from being taxed again on this amount when the shares purchased are eventually sold.

Non-Taxable Dividends - Non-taxable dividends, such as from municipal bond funds, can be indicated by manually entering "0" in the Estimated Tax field. Alternatively, the non-taxable status can be indicated in the security list record by setting the Federal and Local tax rate factors to zero, in which case estimated tax will be computed as "0".

Money Market Funds - Payments received on money market fund holdings should be coded as "dividends", using the DV+, DVW or DRI transaction codes depending upon whether the payment is credited to cash, withdrawn, or reinvested. Technically, these payments are not considered interest payments and should not be entered using interest transaction codes.