|

Cost Basis Adjustment |

|

|

|

|

Cost Basis Adjustment |

|

|

Cost Basis Adjustment

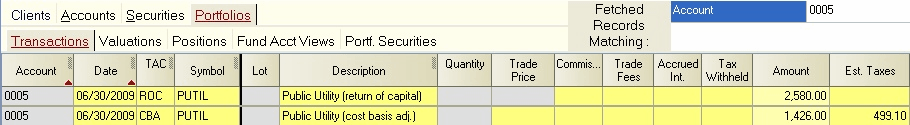

The taxable cost basis of an investment is usually automatically computed by Captools based upon the preceding transaction history. Occasionally, however, there is a need to adjust that cost basis. This can occur, for example, if the investment has passed through tax benefits, such as depreciation or return of capital, which have exceeded the allowable level. In this case, a CBA transaction, such as in the following example, may be necessary to prevent the cost basis of an investment from going negative:

Although the cost basis adjustment in this example is positive, in some cases the adjustment will be negative. In these cases, you must explicitly enter the negative sign for the amount field entry.

Cost Basis Adjustment in Aux. Amount - A cost basis adjustment can also be implemented as a part of reinvestment transactions or opening transactions (DRI, CGR, SGR, RCR, BUY, BYD, SLS, or BRW) by entering the cost basis adjustment amount in the Aux. Amount field. This is the preferred method of handling a cost basis adjustment which is related to a specific transaction.