|

Borrowed Funds |

|

|

|

|

Borrowed Funds |

|

|

Borrowed Funds

Funds which are borrowed for investment can be handled in two possible ways in Captools portfolios, depending upon the source of the borrowed funds.

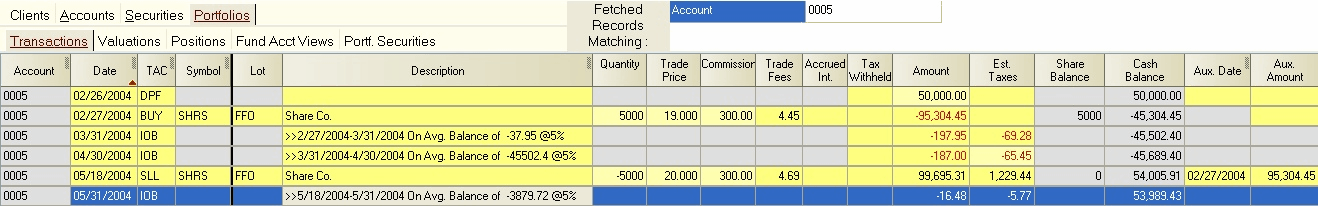

Margin Borrowing - If the funds are borrowed on "margin" from a brokerage firm, and all securities in the portfolio are either held at that firm or are traded through that firm, then you can simply buy more securities than you have cash in your account. Captools' Cash Balance will go negative to indicate that you are borrowing. Your monthly brokerage statement will list interest charges for the money borrowed. These charges should be entered, with a negative amount, as IOB (Interest on Balance) transactions. Repayment takes place automatically when enough shares are sold to bring the account cash balance back to a positive number. The following is an example of this scenario:

Third Party Borrowing - If funds are borrowed from an entity other than the broker holding the portfolio, you can enter an explicit "borrow" transaction in the portfolio using the BRW transaction code. Funds which are repaid are entered using the RPY transaction code. This type of borrowing is typical of real estate transactions where a mortgage is taken out on the investment property at the same time that it is purchased. An example of a real estate transaction is shown under the topic Real Estate.